This report was funded by the Can Manufacturers Institute. However, Metabolic is an independent research organization and our assessment was not designed to support any particular outcome. We took an objective stance throughout the research process and have made our assumptions transparent in the report documentation. This work represents our own insights and recommendations based on our analysis. We welcome questions and feedback from anyone interested in discussing our assessment further.

Executive Summary

Over the last decade, the concept of a circular economy has gained significant support from businesses, governments, and the public as the way forward on solving some of the most pressing environmental challenges we currently face – from climate change to ocean pollution.

Our current economy is linear. We extract vast quantities of resources and use them (often very briefly) before throwing them away. Less than 10% of the materials that pass through our economy each year are recycled.1 Not only do many of these wasted materials end up polluting our environment; they also represent billions of dollars of value thrown in the trash. As just one example, an estimated 45 billion aluminum cans that could be recycled end up in landfills each year in the United States alone, representing $800 million of wasted value.

The urgency and benefits of moving toward a circular economy are clear. We need clean, stable secondary material streams that can compete with primary resource production. We need to keep those materials in circulation as long as possible at their highest and best use. Forever, if we can. The key question is: what actions do we need to take in order to make this transition happen?

Circular Potential

This report examines three beverage packaging materials in the United States (aluminum, glass, and PET plastic2) to understand their current level of circularity and identify what actions are required to bring these product systems into fully circular operations. Combining a life cycle impact assessment and a dynamic material flow model of how material recovery would change over time under different scenarios, we conclude that:

Aluminum Cans

Aluminum cans have the highest circular potential of the three materials evaluated, particularly in the current U.S. recycling system. When considering sorting and processing losses, nearly 82% of aluminum in used beverage cans (UBCs) entering the U.S. recycling system is recovered and remelted for high-quality closed-loop recycling. However, the annual recycling rate for UBCs hovers around 50%, representing significant potential for improvement through increased collection. The production of virgin aluminum is very resource intensive, but using secondary aluminum instead drastically reduces environmental impact. Aluminum cans produced in the United States have an average recycled content of 73%, coming from both pre- and post-consumer aluminum scrap.

The maximum closed-loop recycled content limit for aluminum cans is currently 90%, with the remaining 10% coming from primary aluminum to adjust the alloy composition.3 The tops of aluminum cans are currently made of a different alloy than the can body, which blend together when recycled along with other types of aluminum scrap, requiring primary aluminum to maintain key material properties. To increase this recycled content limit and reach a fully circular closed-loop system, aluminum beverage cans would need to be redesigned to be made of a single alloy – a move that presents several systemic drawbacks, such as increased material use and higher costs. Instead, we recommend investing in new recycling technologies that separate the can top from the can body alongside investments in alloy sorting technologies to maintain key material properties while raising the recycled content ceiling for aluminum cans.

1 Haas et al. (2015). 2 PET stands for polyethylene terephthalate, the most common plastic type used in beverage containers. 3 Technically, aluminum manufacturers can also adjust the alloy composition using aluminum scrap with the right alloy properties to create a can made of 100% recycled content. In practice, however, primary aluminum is often used due to economic reasons and reliability of primary aluminum supply.

Glass Bottles

Our model shows that glass has the second highest circular potential of the three materials evaluated. Glass collected in single-stream recycling systems often ends up downcycled or discarded: 40% is sent to landfills, 40% is recycled into fiberglass or containers, and 20% is used for low-value applications. By contrast, 97% of the glass collected in deposit systems can be recovered for high-value recycling. Since nearly half of the glass collected for bottle-grade recycling comes from the 10 states that have implemented deposit return systems, we calculate that 59% of glass collected in the U.S. recycling system can currently be turned back into glass bottles for closed-loop recycling.

The amount of valuable raw materials like silica and soda ash that can be saved through increased glass recycling is tremendous, adding up to an additional 9 billion pounds of glass cullet per year for bottles produced in the United States. However, since the glass recycling process within the current energy system has limited life cycle CO2e improvements over virgin glass production, the most promising pathway toward circularity for glass is to focus on product reuse. While reusable glass bottles require a thicker design, glass bottles can be washed and refilled up to 25 times before needing to be recycled, which also eliminates the need to harvest raw materials for glass production. To maximize the circular impact reduction potential of glass, bottle deposit systems should be expanded and redesigned towards localized glass bottle refill/reuse systems, with unusable bottles directed towards glass recycling.

PET Bottles

Based on our model, PET currently has the lowest circular potential of the three materials investigated, as only 13% of collected PET is currently converted back into food-grade recycled PET (rPET). While additional rPET is directed towards other beneficial uses, such as fibers and films, these products are less likely to be recovered again for continued high-value recycling. The material properties of PET degrade when it is recycled (around one-third of PET is lost during mechanical recycling processes) and there are significant challenges with incorporating recycled PET into food grade applications. For these reasons, we find it unlikely that recycled PET will systematically displace the production of virgin PET in the current U.S. recycling system.

Another challenge is that virgin PET prices fluctuate with the price of oil, which has consistently made it difficult for rPET to compete on price with virgin material. The pathway toward a circular PET system is much more challenging than for the other two materials examined. It rests critically on much purer material collection (for example, through deposit return systems) and on the development of economically and environmentally viable chemical recycling solutions.4 While some companies are exploring refillable PET systems with thicker bottles as a potential strategy to reduce their material footprints, reusing plastics can be problematic due to sterilization issues and buildup of contaminants, and these bottles still face the same systemic recycling issues at the end of their useful life.

4According to the “Breaking the Plastic Wave” report released by Systemiq (2020), chemical recycling of plastics has not yet been proven at scale, and has higher costs and emissions compared to mechanical recycling. This highlights the importance of decarbonizing energy sources alongside investments in scaling up chemical recycling technologies.

Aluminum Can Recycling: A Leverage Point for Impact Reduction

The impact reduction potential of reaching a 100% collection rate for used beverage cans is significant. We calculate that once a 100% deposit collection rate is achieved for each material type, the total emissions impact reduction potential for recovering one metric ton of aluminum cans is 3 times higher than PET bottles and 42 times higher than glass bottles. Not only are aluminum cans the most valuable of the three materials from an economic perspective, they are also the most valuable to recycle from an emissions impact reduction perspective.

When compared to current recycling rates in the United States, the impact of recycling 100% of aluminum cans has the potential to save an additional 6 million metric tons of CO2e each year – the equivalent of the annual CO2e emissions from electricity used in over 1 million U.S. homes. To put the quantity of increased UBC collection in perspective, doubling the current annual collection rate of aluminum cans adds the same amount of aluminum to the U.S. economy as dismantling 7,500 airplanes – equivalent to the entire U.S. commercial aircraft fleet.

Doubling the current annual collection rate of aluminum cans adds the same amount of aluminum to the U.S. economy as dismantling 7,500 airplanes – equivalent to the entire U.S. commercial aircraft fleet.

Once collection rates reach 100%, the same piece of aluminum could be used over multiple recycling loops with the only material losses occurring in the shredding and remelting processes at a 94% combined efficiency rate. When stretched over 40 recycling loops, we calculate that one aluminum can recycled over and over again has the potential to displace the material equivalent of 15 aluminum cans.

Key Recommendations

Ensuring that all products and materials are designed to cycle at their highest value is about much more than just optimizing the existing recycling system. Changes are required across all the steps of the value chain – from product design to material collection – in order to ensure that recovered resources are actually displacing virgin material and continuing to circulate at high value. In fact, this study shows that we cannot reach a circular system simply by maximizing recycling under current conditions. Key actions need to be taken across these product value chains to make progress toward a fully circular system in the U.S. beverage packaging sector:

- Business models and collection incentives need to be aligned for each material type (e.g., glass should be driven toward refillable systems; aluminum cans toward increased recycling; and plastic towards deposit return systems).

- Collection rates for all three materials must be dramatically increased. This can happen by increasing curbside collection while advocating for deposit return systems – such as the bottle bill system – to be rolled out across the United States.

- While bottle bill deposit systems are being set up, PET producers should invest in chemical recycling technologies and critically assess the life cycle impacts of these processes, shifting towards renewable sources of energy if impacts are high.

- The aluminum industry should explore new recycling technologies that separate the can top from the can body in the recycling process. This would help maintain aluminum alloy properties over multiple recycling loops and raise the recycled content ceiling for aluminum cans. In general, all containers should be designed in a way that minimizes the chance of mixing materials or alloys in the recovery process, for example by removing unnecessary design features to improve the quality of recovered materials.

- Material recovery facilities should invest in additional eddy current technologies, which magnetize and separate aluminum from other material types, to ensure all aluminum cans that enter the recycling system can be sorted correctly for recycling.

- Decision-makers should monitor progress toward circularity not just by measuring and acting upon recycling rates, but also by evaluating annual rates of material displacement,5 measuring whether materials collected for recycling are used in open-loop or closed-loop systems, determining whether materials are recycled into products that can easily be recycled again, monitoring the material and energy efficiency of the recycling process, and quantifying the impact of interventions from a systems-oriented life cycle perspective.

- Finally, beverage producers should explore reducing the need for beverage packaging altogether by investing in drink concentrates, home-based beverage systems, and other solutions that meet consumers’ needs while reducing overall packaging production.

By implementing these key recommendations, we have the potential of achieving a fully circular beverage packaging system. This coordinated effort will require action from politicians, manufacturers, and consumers: we must all collaborate to reach a circular future.

5 Displacement refers to the actual amount of primary material demand that is reduced as a result of material reuse or increased secondary (recycled) material production.

Definitions

Linear Economy:

References a particular way in which materials flow within an economic system. It is commonly used to characterize our current economic model, which follows a “take-make-dispose” pattern where most materials are disposed of after a single use and cannot be recovered for continued circulation. In a linear economic model, the creation of value is fundamentally dependent on the ever-expanding production and sale of goods, which requires continual extraction of natural resources.

Circular Economy:

This is an alternative to the current linear model; it is waste-free by design, leverages renewable resources, and equitably generates economic, natural, and social capital safely within the planetary boundaries. It acknowledges that we live on a planet with finite resources, and therefore aims to retain valuable and critical materials flowing in the economic system at their highest and best value.6

Raw Material Displacement:

Refers to the reduction of virgin materials required in the production of goods by increasing the use of secondary materials or reducing demand of virgin materials through product reuse.

Displacement Rate:

An economic indicator that represents the percentage of raw materials that are no longer extracted and produced because of increased supply of secondary (recycled) materials or reduced demand through product reuse, from a system wide perspective.

Closed-Loop Recycling:

Refers to reintegrating recycled materials back into the same type of product without significant losses in material quality or functionality. In this paper, we use bottle-to-bottle and can-to-can recycling as a proxy for closed-loop recycling, to highlight the circular potential of recovering and reusing these materials at the same quality over multiple recycling loops.

Open-Loop Recycling:

Refers to using recycled materials in products that differ from the original product system, typically changing the material quality or function. If the material loses significant quality or value, this can also be referred to as downcycling.

6 See Metabolic’s Seven Pillars of the Circular Economy framework for more information: https://www.metabolic.nl/news/the-seven-pillars-of-the-circular-economy

Introduction

Over the last decade, the concept of a circular economy has gained significant popularity as a potential pathway for solving some of the most pressing environmental challenges we currently face – from climate change to ocean pollution. Our current economy is linear. We extract vast quantities of resources, use them (often very briefly), and then send them to landfills or disperse them into the environment in a way that they are unrecoverable – for example, through incineration, the dispersal of chemicals, or the use of products like paints that are not designed for recovery. Less than 10% of the materials that pass through our economy each year are recycled.7Not only do many of these wasted materials end up polluting our environment; they also represent billions of dollars of value thrown in the trash.

By contrast, a circular economy is waste-free and regenerative by design, where our production and manufacturing are modeled much more closely after nature and material resources are designed to cycle indefinitely at high value. As you walk through a forest, you can be sure that everything you see around you, from the soil to the birds, is part of a continuous, regenerative cycle where nothing ever becomes “waste.” We should design our industrial systems in line with circular principles. So what are the steps to make that happen?

In this study we applied dynamic modeling techniques to look at the U.S. beverage packaging sector and explore what it would take to bring it to a fully circular state. Our conclusions vary drastically for each of the three main types of materials we investigated, and, perhaps surprisingly for many, the pathway to circularity does not simply rely on increasing levels of recycling. Recycling represents one part of a larger system that needs to work properly to maintain a functioning circular economy. Products need to be designed for circularity, incentives need to be put in place for high-quality and pure material recovery, and value chain partners need to collaborate on everything from reverse logistics8 to the creation of a robust market for secondary materials. All of these changes require a broader systems transformation. We recommend using additional metrics – such as material displacement – to more accurately track our progress on the journey toward a circular economy.

7 Haas et al. (2015). 8 Reverse logistics refers to the process of moving materials away from disposal and back into the product value chain for recycling, reuse, or remanufacturing. Lacy et al. (2020).

Toward a Circular Beverage Packaging System

Each year, the average U.S. citizen consumes 800 beverages packaged in disposable containers, primarily made of aluminum cans, PET plastic, and glass bottles.9 While over half of U.S. households have access to curbside recycling services,10 the majority of these 200+ billion containers end up in the trash, resulting in significant economic and environmental losses. Even aluminum cans, which are the most recycled beverage container in the United States and the world,11 have a recycling rate in the U.S. of only around 50%.12 An estimated 45 billion aluminum cans end up in landfills each year in the United States alone, representing $800 million worth of material that is being thrown away.13 That’s the equivalent of each U.S. citizen tossing nearly a dozen 12-packs of used aluminum cans in the trash every year.

Around 45 billion aluminum cans end up in landfills each year in the United States alone. That’s the equivalent of each U.S. citizen tossing nearly a dozen 12-packs of used aluminum cans in the trash every year.

For a material like aluminum with both a high circular potential and high raw material production footprint, this is a huge waste. Not only is the economic value of this aluminum thrown away,13 but the embodied energy, water, and GHG emissions associated with producing these cans are also squandered.

Criteria for a circular system

A circular system starts with circular design. This involves selecting materials and designing products in a way that allows materials to be easily broken down and reintegrated back into production (or fully biodegrade into natural systems) at the end of their useful life. Recycled materials can either be turned back into the same type of product (closed-loop recycling) or used in a different product system (open-loop recycling).14 In some cases, products can be designed in a way that allows for multiple cascading loops over several product lifetimes, as material properties change or degrade over time.

The environmental benefits of creating a strong circular system come from displacing primary resource production – in other words, ensuring that recycled materials are actually used to create new, high-quality products instead of the virgin resources that would otherwise be used. Setting up a system that allows materials to circulate at their highest and best use typically reduces the demand and associated impacts of harvesting raw materials.15 Displacement can also be achieved through other strategies such as product reuse. Every decision made in a circular economy should be done in a way that maximizes impact reduction potential and allows materials to be circulated at their highest and best use, indefinitely.

In a properly functioning circular system, permanent materials such as aluminum and glass could, in theory, be used forever. In practice, however, there’s no such thing as an inherently circular product or material, since all materials have the potential to be handled in a non-circular way. Circular products and materials only exist within a functioning circular system that supports the collection, handling, processing/reuse, and reintegration of these materials back into production systems.

9 Gitlitz, J. (2013). 10 Mouw et al. (2020). 11 Can Manufacturers Institute. (Oct 24, 2017). 12 The Aluminum Association. (2019). 13 Lee, G. (November 15, 2019). 14 In this paper, we use bottle-to-bottle and can-to-can recycling as a proxy for closed-loop recycling, to highlight the circular potential of recovering and reusing these materials at the same quality over multiple recycling loops. 15 Displacement refers to the actual amount of primary material demand that is reduced as a result of material reuse or increased secondary (recycled) material production. In practice, the actual displacement rate is highly dependent on economic factors. As noted in Zink (2018), reaching a 100% displacement rate is unlikely. However, setting up a strong market for secondary materials that compete with primary materials can improve the displacement rate and associated impact reduction potential of a circular intervention.

Circular products and materials only exist within a functioning circular system that supports the collection, handling, processing/reuse, and reintegration of these materials back into production systems.

A circular system puts recycling rates into context

To achieve a truly circular system, we need to go beyond just talking about recycling rates. We need to focus on ensuring circular systems are designed in a way that maximizes impact reduction potential, prioritizes high-value material recovery, and displaces primary raw materials.

If we only discuss material recycling rates, we focus the conversation on the amount of material collected and diverted from landfills. That is only part of the recycling story. Instead, we should assess whether the recycled materials are actually being used at their highest and best value – and whether, therefore, they are replacing the need for as much new, virgin material to be introduced. A successful recycling system should create a strong and reliable source of secondary materials that can compete with primary resource production.

A successful recycling system should create a strong and reliable source of secondary materials that can compete with primary resource production.

This can be achieved by designing products and processes that facilitate continued circulation at high value with minimal losses, highlighted in Figure 1.

Assessing the circularity of beverage containers in the U.S. recycling system

In this paper, we assess three key packaging materials – aluminum cans, PET bottles, and glass bottles – on their circular potential in the U.S. context.16

Our analysis dives into the following topics:

Chapter 1: Design

We discuss how the material properties of each beverage container determine how these products should be designed for a circular system.

Chapter 2: Production

We assess the life cycle impacts of producing each material, with an eye towards whether material recovery will result in significant reductions in energy, water, and GHG emission impacts across the three packaging types.

Chapter 3: U.S. Recycling System Assessment

We map out how each material is currently being collected, processed, and recovered in the current U.S. recycling system in a material flow analysis, highlighting the key system leverage points that inhibit reaching a circular state.

Chapter 4: Intervention Scenarios

We model the potential for circularity by improving the U.S. recycling system through three hypothetical scenarios: increased collection, improved sorting technologies, and implementing a national bottle deposit system.

Finally, we provide recommendations for stakeholders across the beverage container value chain to participate in creating a robust circular system by prioritizing strategies that maximize impact reduction potential and allow materials to circulate at their highest and best use.

16 We excluded beverage cartons from this analysis due to a lack of publicly-reported data tracking the rate of multi-layer carton recycling in the United States. According to the Carton Council, the curbside recycling rate of beverage cartons was 16% in 2019, but the trade group has not reported the methodology for calculating this recycling rate. We urge the Carton Council to report recycling data and methodology to the EPA to allow for a comparison across all beverage container types.

01 Design

Design is destiny. The way a product is designed, and the inherent properties of the materials it is made of, greatly influence whether the product is destined for continuous circulation or eventual disposal. This is quite apparent when comparing aluminum cans, glass bottles, and PET bottles. If a product is designed in such a way that it remains a high-value material resource at the end of its useful life, then producers won’t have to source virgin raw materials to continue manufacturing that product and can instead rely on using materials already in circulation. Let’s dive into the details.

How do the material properties of PET, glass, and aluminum influence the packaging’s circular potential over infinite recycling loops?

Aluminum Cans

Aluminum is touted as a highly circular, infinitely recyclable material that doesn’t degrade in the recycling process. Because of this, the International Aluminum Institute estimates that 75% of aluminum ever produced is still in use today. Cans are designed as a single-use product, which are shredded and remelted directly back into the aluminum production system. When the aluminum can was originally designed over 60 years ago, recycling and waste reduction goals were a key part of the full system design.18

Aluminum cans are actually made of two different types of aluminum alloys — the result of advancements in can lightweighting efforts. The can body, which makes up about 80% of the can by weight, is made of a 3104 alloy with higher levels of manganese than the rest of the can. The top and tab are made of a 5182 alloy with comparatively higher levels of magnesium.19 Both alloys allow for high levels of recycled content from a variety of sources. When recycled, however, the alloy types mix together and require additional material inputs to re-balance the different alloy properties.

Therefore, some primary aluminum is still required to balance out impurity elements and to maintain the can’s alloy properties. Because of this, the aluminum can has a theoretical recycled content limit of around 90%.20 This represents one barrier for the aluminum can system to completely break away from virgin material production.21

A unialloy aluminum can is technically possible,22 but creating a unialloy aluminum can is not practical from a systemic perspective. A unialloy can design would require additional material to strengthen the can, which would increase material and production costs. In addition, a thicker unialloy can would result in higher material losses for every can that is not properly collected and recycled, plus additional aluminum lost in the shredding process. Alternatively, the aluminum industry can explore new recycling technologies that separate the top from the body in the can recycling process, moving towards a system that separates and maintains alloy purity over multiple recycling loops.

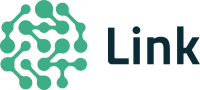

Today’s average aluminum can in the U.S. is made of 73% recycled content, with 43% of a can coming from collected used beverage cans (UBCs), as shown in Figure 2.

Aluminum cans also contain a thin lining made of epoxy resin to keep the beverage from interacting with aluminum. To break away from petroleum-based plastics used in cans, the can manufacturing industry should explore investing in biobased epoxies as a potential substitute,25 preferably using secondary feedstocks to reduce primary material consumption.26

As will be described in Chapter 2, the environmental performance of an aluminum can is highly dependent on the amount of recycled aluminum in the product. Since the alloy used in aluminum cans is highly forgiving, and because the recycling process is highly efficient, producers should actively prioritize sourcing recycled content for aluminum cans and eliminate any unnecessary raw material inputs.

17 Betram et al. (2017).18 Buffington, J. (2012). See also Anton (2019) on how Bill Coors designed the aluminum can with recycling in mind. 19 Buffington, J., & Peterson, R. (2013).20 Based on literature review and conversations with aluminum can manufacturers. See also Novelis (2013) introducing an aluminum can made from 90% recycled content. 21 Technically, aluminum manufacturers can also adjust the alloy composition using aluminum scrap with the right alloy properties to reach a 100% recycled content aluminum can, but in practice primary aluminum is often used due to economic reasons and reliability of primary aluminum supply. 21 Buffington, J., & Peterson, R. (2013). 23 The Aluminum Association. (2019). 24 Part of the post-industrial scrap category includes the “class scrap” that is cut off from sheets of aluminum during the can manufacturing process. This is the ideal closed-loop recycling scenario, since the scrap material exactly matches the alloy requirements for both the can body and top. In addition, this class scrap does not include any contaminants such as coatings, shrink wraps, and plastic closures, which are commonly found in post-consumer materials. These extra packaging design elements reduce efficiency and increase costs for recyclers, so these additions should be minimized to improve the economic viability of aluminum UBC recycling. 25 Roudsari et al. (2017). 26 Fernandes et al. (2018).

The properties of aluminum allow the material to be sorted and separated in material recovery facilities (MRFs) via eddy currents from mixed waste streams at around 95% effectiveness.27 Eddy currents collect all types of aluminum, including aluminum foil, resulting in bales of mixed aluminum which are sold for continued processing. Aluminum can also be recovered from bottom ash after incineration, which provides an additional source of recycled aluminum to the system. However, to maintain material purity and high recovery rates, UBC collection through traditional recycling methods is preferred. Deposit systems provide the cleanest UBC material streams, which is the best option for a closed-loop recycling system.

Based on these design considerations, recycled aluminum cans have a high potential to displace primary aluminum production, as long as the collection infrastructure and systems are in place to provide a reliable supply of secondary materials that meet alloy specifications. Since aluminum recycles forever, creating a reliable collection system allows new cans to be made from the same aluminum over and over again.

Since aluminum recycles forever, creating a reliable collection system allows new cans to be made from the same aluminum over and over again.

The processing infrastructure is already in place to continue circulating aluminum cans at scale. However, since many different types of aluminum alloys are collected and recycled together, the aluminum can system will continue to require additional raw material input until systems are in place to efficiently separate and sort different types of aluminum alloys for continued recycling. Technologies such as laser spectroscopy can rapidly assess and sort mixed aluminum sources by alloy types,28 reducing the need for primary aluminum to re-balance alloy specifications in the remelting process.

Looking beyond what the aluminum can industry can do alone, particularly considering the high displacement potential for aluminum, the challenge for the aluminum industry overall is to monitor the rate that total primary aluminum demand actually decreases with increased recycling rates. This requires coordination across the aluminum value chain (beyond just can manufacturing) to expand the recovery of high-value secondary materials that can compete with – and ultimately reduce – primary aluminum production. The environmental impact savings associated with aluminum recycling are highly dependent on the raw material displacement rate, so the aluminum industry overall should prioritize monitoring raw material displacement while increasing recycling rates to strengthen its sustainability story and environmental performance.

The aluminum industry should prioritize monitoring raw material displacement while increasing recycling rates to strengthen its sustainability story and environmental performance.

27 Simmons, S. (2020). 28 For example, see “New sorting system for separating aluminum alloys” featured in Recycling Magazine in 2016: https://www.recycling-magazine.com/2016/10/17/new-sorting-system-for-separating-aluminium-alloys/. See also: Kuzuya, M. (2019).

Glass Bottles

Glass, like aluminum, is also a permanent material, which means glass maintains its physical properties throughout the recycling and recovery process.29 Recycled glass cullet30 can easily be integrated back into the bottle production system with minimal losses. On this metric alone, glass would seem to have a potential to reduce its impact through recycling, but in practice the potential for creating high-value secondary markets for glass is less promising.

Glass is heavy and breaks easily. The heavy weight means glass requires more material to deliver the same amount of beverage to consumers, resulting in a higher environmental footprint and increased transportation impacts compared to the other packaging types.31 Broken glass is difficult to manage, particularly in single-stream recycling systems. Furthermore, the low (or negative) value of collected glass often means the material ends up being used for low-end applications or landfill cover, rather than for high-end applications that displace virgin glass production. Given these considerations, the likelihood that glass collected in the recycling process will provide a consistent enough supply to compete with primary glass production is quite low.

Of the glass bottles collected in single-stream recycling systems, 40% is recycled into fiberglass or glass containers, 20% is glass fines (small, broken glass) used in low-end applications, and 40% is sent to landfills. In comparison, 97% of the glass collected in deposit systems can be recovered for high-value recycling.32 Because of the cleaner material streams from deposit systems, nearly half of the glass collected for bottle-grade recycling comes from the 10 states that have implemented bottle bill legislation.33

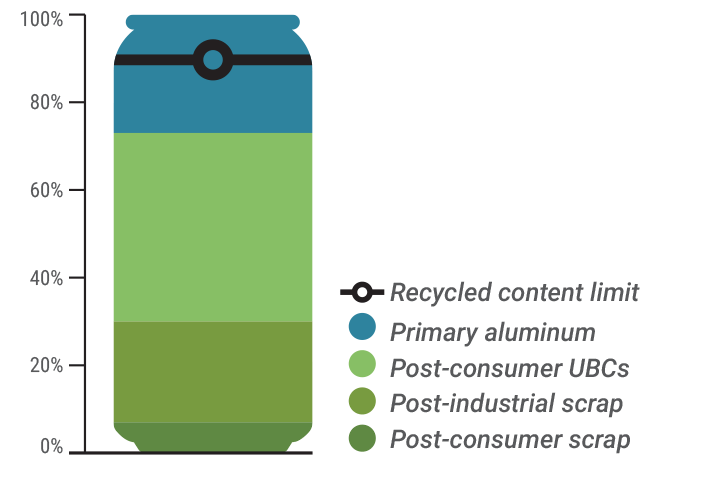

The average recycled content of glass bottles is around 27.5%.34 The maximum recycled content limit depends on the color of the bottle, since each color type can tolerate different levels of color contamination, shown in Figure 3.35 Green glass has the highest recycled content limit at 90%, followed by amber glass at 70% and clear (flint) glass at 60%. Because of these color contamination constraints, glass must be sorted by color as part of the recycling process before it can be reused for bottle production.

Since the vast majority of energy and GHG impacts occur in the glass manufacturing process, which the recycled glass also undergoes, the environmental savings associated with glass recycling are actually quite minimal when compared to the other packaging types. 36 Because glass bottles are durable and can be sterilized, the best strategy for glass bottles to reduce life cycle impacts and displace primary material production is to prioritize reuse.

Because glass bottles are durable and can be sterilized, the best strategy to reduce life cycle impacts and displace primary material production is to prioritize reuse.

This will require setting up a strong network of glass bottle collection, sterilization, and reverse logistics, prioritizing local networks to reduce transportation impacts. Reusable glass bottles may need to be designed with additional material to ensure product durability over multiple use cycles. However, glass bottles can be reused up to 25 times before being disposed of or recycled,37 which greatly improves the potential for raw material displacement and associated impact reduction potential. Once glass bottles can no longer be reused, the material should be collected and recycled back into new bottles.

29 Geueke et al. (2018). 30 Glass cullet refers to crushed glass ready to be remelted in the glass recycling process. 31 See Section 2 and Appendix 1 for more details. 32 Gitlitz, J. (2013).; Majdinasab, A., & Yuan, Q. (2019).; Damgacioglu et al. (2018). 33 The Container Recycling Institute. (2020). 34 Average glass recycled content based on LCA estimates from Franklin (2018, 25%), RTI (2003, 27.5%), and Franklin (2009, 30%). 35 Dyer, T. (2014). 36 Described in more detail in Section 2. 37 Cattaneo, J. (March 12, 2019).

PET Bottles

PET is a lightweight and durable material that makes it easy to transport and distribute goods. However, unlike aluminum and glass, PET is a non-permanent material that loses material properties in the mechanical recycling process. Because of this, PET can be recycled a maximum of 10 times before the polymer chains are no longer usable for high-grade purposes.38 The number of times PET can be recycled is higher than for other types of plastic, some of which can only be recycled 2-3 times before the material quality is no longer sufficient for high-value reuse.39

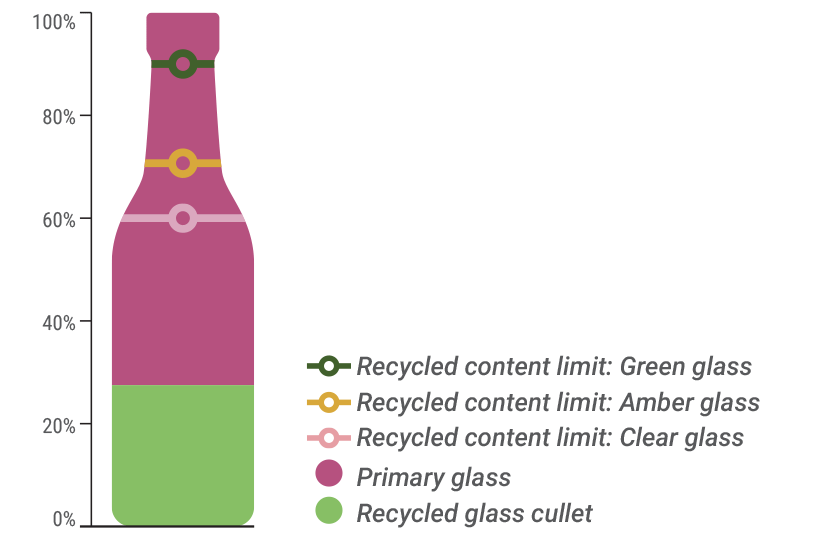

In a closed-loop system, the recycled content ceiling for PET bottles is highly dependent on the material purity of the collected materials in the recycling system. A recent study shows that PET bottles collected and recycled through mono-collection systems (such as bottle deposits) allow for higher amounts of recycled content compared to PET bottles collected in mixed recycling systems (such as single-stream recycling).40 This is because contamination in the mechanical recycling process over multiple cycles changes critical PET properties such as haziness, yellowing, and migration of volatile compounds.

While producing a 100% recycled PET bottle is technically feasible, the practical recycled content limit for PET in a closed-loop system depends on the material purity of the collection system, along with the contamination acceptance limits set by the producing company. Brouwer et al. (2020) explore the recycled content limits for PET bottles in a closed-loop system across three critical properties. Recycled content limits for mono-collection systems range from 51% – 93% (midpoint: 72%), clean co-collection systems range from 37% – 83% (midpoint: 60%), and more contaminated co-collection systems range from 16% – 70% (midpoint: 43%).41 Therefore, increasing the recycled content of PET bottles should go hand-in-hand with improving the collection methods in a circular system.

Increasing the recycled content of PET bottles should go hand-in-hand with improving the collection methods in a circular system.

See the gradients in Figure 4 for the PET recycled content limit ranges for each collection method.

In the United States, the current recycled content of PET bottles is estimated to be around 6%.42 Packaged goods companies who have signed the New Plastics Economy Global Commitment have set goals to reach 22% post-consumer recycled content in their packaging by 2025.43 However, the recent “Talking Trash” report by Changing Markets Foundation (2020) uncovers how voluntary commitments by large producers to increase recycled content and improve material collection have been largely ineffective in curbing plastic pollution.44 Furthermore, these same producers have consistently lobbied against rolling out bottle bill deposit return legislation that has been proven to improve the quality and quantity of collected materials for recycling.

According to research by Closed Loop Partners, the current supply of post-consumer recycled plastics can only reach 6% of total recycled plastics demand.45 The Recycling Partnership estimates that an additional 1.6 billion pounds of PET bottles will need to be collected in the U.S. in order to reach a 25% recycled content goal for PET bottles.46 That’s the equivalent of each U.S. citizen recycling 100 more PET bottles each year. This would require the U.S. PET recycling rate to increase by 27%, assuming all additional rPET is diverted towards food grade plastics – which is unlikely in the current U.S. recycling system since around 75% of rPET is used for non-food applications.

38 Spary, S. (September 27, 2019). 39 National Geographic. (April 4, 2018). 40 Brouwer et al. (2020). 41 See Brouwer et al. (2020), Table 3 for a more detailed breakdown for recycled content limits for lenient and strict thresholds across three critical parameters, including haziness, yellowing, and migration. 42 NAPCOR & APR. (2018). 43 Kersten-Johnston et al. (2019).; New Plastics Economy. (2019). 44 Changing Markets Foundation. (2020). 45 Closed Loop Partners. (2019). 46 Kersten-Johnston et al. (2019).

There are many barriers to achieving recycled content goals for PET in the United States, particularly for food-grade plastics. Incorporating rPET into food packaging requires the material to be traced back to food-grade sources,47 which is most effectively achieved through bottle deposit systems. Chemical recycling opens up new opportunities for PET recycling that can bypass food-grade rPET recycling restrictions, but scaling up chemical recycling needs to go hand-in-hand with decarbonizing energy sources.48

In addition, the economic viability of recycled PET is highly dependent on the price of oil. As seen in the current COVID-19 crisis, when the price of oil plummeted, so did the price of virgin PET,49 while the costs to produce rPET remained the same. When considering the billions of subsidy dollars that fossil fuels receive from the U.S. government,50 petrochemicals used to make virgin PET will almost certainly continue to have artificially low prices and outcompete rPET on the open market. Unless paired with a cross-industry commitment to scale back PET production in line with increased recycled content commitments, the total amount of PET put on the market will continue to grow – as will the total amount of PET disposed.

These factors do not bode well for the impact reduction potential of PET in the U.S. market. Unless producers have a reliable feedstock of recycled materials at a low price to reduce demand for virgin PET, the market demand for virgin PET will remain strong. As long as virgin PET continues to be produced at a low price, producers will find a way to use it in single-use products, even outside the PET bottle market. Increasing the amount of recycled content in PET bottles without turning off the tap for virgin PET production will simply continue to increase the total amount of PET in circulation. Plastic production is expected to triple by 2050,51 resulting in more and more material entering a system that was not designed with long-term circularity in mind.

Recent deep-dives into the history of the plastics industry have uncovered that plastics were never designed to be recycled at scale.52 As mentioned above, the key challenge lies in the economics: new plastic, made from oil and gas, is almost always less expensive and of better quality than recycled plastic. Plastic recycling initiatives and anti-littering campaigns were originally created by oil and petrochemical industries to divert attention away from plastic pollution and to improve the public image of plastics, rather than providing economically viable solutions for plastic recycling that can compete with virgin plastic production.

While chemical recycling technologies have the potential to overcome PET mechanical recycling limitations, further research needs to be done to fully understand whether the increased energy demand and emissions associated with chemical recycling will outweigh the environmental savings from a life cycle perspective. In addition, these technologies require additional time and investments to reach scale.53

47 FDA. (2018). 48 According to the “Breaking the Plastic Wave” report released by Systemiq (2020), chemical recycling of plastics has not yet been proven at scale, and has higher costs and emissions compared to mechanical recycling. This highlights the importance of decarbonizing energy sources alongside investments in scaling up chemical recycling technologies. 49 Wenzel, E. (May 22, 2020). 50 Nuccitelli, D. (July 30, 2018). 51 Sullivan, L. (September 11, 2020). 52 See the NPR article “How Big Oil Misled The Public Into Believing Plastic Would Be Recycled” for more information (Sullivan, 2020). 53 Kersten-Johnston et al. (2019).

02 Production

Where are the largest energy, water, and greenhouse gas (GHG) emissions occurring in the production of these packaging types, and to what extent will recycling reduce these impacts?

Let’s now take a look at the main environmental impacts of each material’s production system. We scaled environmental impacts across the product’s life cycle to see where the largest energy, water, and GHG emissions are occurring. By mapping out these material and energy flows, we can identify the key impact areas associated with production of each packaging type. This information can be used to better understand the environmental claims associated with recycling these packaging materials.

Our assessment is based on a functional unit of providing 1000 liters (L) of beverage in 12-oz containers produced in North America. The use phase has been excluded from the scope of this assessment, and we’ve only included the base material in the analysis for each packaging type (aluminum, glass, and PET). We’ve included a sensitivity analysis for different container sizes and densities in Appendix 1.

Note: See Appendix 1 for our full impact assessment model assumptions and references. Our analysis was based on life cycle assessment methodology, and we used key model assumptions from existing LCA reports, but it is not a full ISO 14040 LCA. Results are intended to show where the relative impacts are occurring across each packaging production system and should only be interpreted using the assumptions built into our model.

For a recent ISO 14040 LCA which compares impacts across different packaging materials and sizes, see the Ball Corporation Life Cycle Analysis completed in 2020 by Sphera, available here.

A note on impact assessment methodologies

Life cycle assessments typically follow one of two methods to calculate the impacts of a system: the recycled content approach and the avoided burden approach.

The recycled content approach

In the recycled content approach, also known as a cut-off approach, the amount of secondary material used in a product is considered to be free of primary material environmental impacts, but it does include impacts associated with transporting and processing the recycled content for use in the product system. The remaining primary materials contain upstream impacts associated with raw material extraction and processing. The system is cut-off at a product’s end-of-life, which means the credits for continued material recycling are excluded from the assessment. When using a cut-off approach, the recycled content is a key variable in determining the life cycle impacts of a product.

The avoided burden approach

In the avoided burden approach, the end-of-life recycling rate becomes a key variable in determining life cycle impacts of a product. Rather than reducing impacts based on the recycled content of a product, credits are given for the amount of material recycled at the product’s end-of-life. These secondary recycled materials are assumed to displace primary materials used in a new product system, with impact reduction credits – as well as the associated impacts from recycling – applied to the original product system.54

We’ve used both the recycled content and avoided burden approaches for our analysis. The results in Chapter 2 correspond to the recycled content approach, with high-level results from both calculation methods highlighted in Figures 5-7. See Appendix 1 for full model results using both approaches.

54 See Nordelöf et al. (2019) for a clear comparison of these two life cycle modelling approaches using lithium-ion battery recycling as the case study.

Aluminum cans

Introduction

Primary aluminum production has high environmental impacts compared to secondary aluminum production, which is why setting up robust systems for high-value material recovery is so important. Since producing secondary aluminum requires 90-95% less energy compared to virgin aluminum production, the high recycled content in aluminum cans greatly reduces an average can’s environmental impact.

Since producing secondary aluminum requires 90-95% less energy compared to virgin aluminum production, the high recycled content in aluminum cans greatly reduces an average can’s environmental impact.

As with any recycled material, the benefits of displaced primary aluminum should outweigh the life cycle costs associated with collecting, processing, and transporting secondary materials for reprocessing, which we explore further for each material type in Chapter 4.

See Figure 5 to explore the energy, water, and GHG emissions linked to each stage of the aluminum can life cycle. The width of each line represents the percentage of the impact that corresponds to each stage.

Functional Unit: Provision of 1000L of beverage in 12-oz cans, 0.01334 kg per can, 73% recycled content (recycled content approach), 49.8% recycling rate (avoided burden approach). Use phase excluded from scope of this assessment.

Aluminum Can Life Cycle Hotspots

Raw Material Extraction

While bauxite mining itself does not require high energy inputs, the strip mining process can lead to wildlife habitat destruction, polluted waterways, and soil erosion, impacting human health and biodiversity.55 The aluminum industry has developed guidelines to minimize these impacts,56 and aluminum producers should monitor their upstream suppliers to ensure proper standards are being met. Bauxite was added to the European Commission’s Critical Raw Materials list in 2020,57 which further highlights the importance of sourcing recycled aluminum for continued high-value circulation.

Distribution

Most bauxite used for aluminum production in the United States is imported from Jamaica and Brazil, which is responsible for 20% of the transportation-related emissions in our model.

Production

The most significant energy, water, and GHG impacts in the aluminum system occur in the production phase, which involves transforming bauxite ore into usable aluminum ingot. This includes both alumina production and aluminum refining, with most impacts linked to refining.

The water depletion associated with the production stage of aluminum cans is linked to the hydropower energy demand in the system, rather than to direct water withdrawals. In the United States, 74% of electricity used for aluminum production comes from hydropower, which is connected to increased water evaporation from reservoirs.58 This burden shift between water, energy, and emissions is further explored in Table 1.

Refining

Electrolysis, used in the reduction of pure alumina in the aluminum smelting and refining process, has the most impacts of any stage across the aluminum can life cycle. This process is responsible for 34% of the cumulative energy demand for all industrial processes in this system, which is especially high considering over two-thirds of the can is manufactured using secondary materials in our model. These impacts are also highly dependent on the electricity fuel mix of the producing country – not all primary aluminum is created equal.58

Can Manufacturing

Can manufacturing includes several processes such as forming, ironing, pressing, trimming, and coating. The electricity and heat needed throughout these processes, coupled with the production of lubricant oil, coatings, inks, and solvents, drive the environmental impacts in this life cycle stage.

Treatment and Recycling

The collection, sorting, cleaning, and recycling process requires a fraction of the environmental costs associated with producing virgin aluminum.

55 Gitlitz, J. (2002). 56 IAI. (2018). In addition, the Aluminum Stewardship Initiative has outlined standards related to primary aluminum production. Retrieved from https://aluminium-stewardship.org/asi-standards/ 57 Bloxsome, N. (September 4, 2020). Bauxite recognised as ‘critical raw material.’ Retrieved from https://aluminiumtoday.com/news/bauxite-recognised-as-critical-raw-material 58 McMillan, C.A., & Keoleian, G.A. (2009). 59 Buxmann et al. (2016).

Key Model Assumption: Energy Grid

The production-related water consumption impacts in the aluminum can system come from the use of hydroelectric power. When changing the model inputs from the hydroelectric industry-specific data to match the average U.S. electricity grid, the environmental impacts across these three categories change significantly, as seen in Table 1.

Impact results rounded to the nearest 5.

GWP = Global Warming Potential CED = Cumulative Energy Demand WDP = Water Depletion Potential

This represents a textbook example of burden shifting between energy, water, and GHG emissions. Switching to U.S. grid electricity drives an increase in GHG-related emissions and energy demand by around 40%, while the water consumption (primarily linked to hydropower) decreases by 64%, displaying, as a result, similar levels of water depletion when compared to the other packaging types.

Glass bottles

Introduction

When examining the life cycle impacts of glass bottle production, an overwhelming concentration of energy and GHG impacts are seen in the manufacturing phase, largely due to the high amount of energy used for melting glass. The higher weight of glass also corresponds with increased transportation emissions from distribution.

Functional Unit: Provision of 1000L beverage in 12-oz bottles, 0.20034 kg per bottle, 27.5% recycled content (recycled content approach), 42% recycling rate (avoided burden approach). Use phase excluded from the scope of this assessment.

Glass Bottle Life Cycle Hotspots

Raw Material Extraction

Glass is mainly made from limestone, silica sand, soda ash, and feldspar. These can all be sourced within the United States, reducing upstream transportation emissions and minimizing critical raw material risks.

Furnace Impacts

The high intensity of natural gas and fuel oil used in glass furnaces account for 82% of the total GHG emissions and 79% of the total cumulative energy demand in the system. These furnaces run constantly for approximately 15-18 years without stopping or cooling down.60 Energy-saving strategies can only be implemented at the end of a furnace’s lifetime, representing a technological lock-in within the glass manufacturing system.

Bottle Manufacturing

Other steps in the glass bottle manufacturing process include batch preparation, melting processes, and final conditioning61 and forming of glass containers to meet production requirements.

Distribution

While the raw materials for glass production and manufactured bottles display shorter shipment distances (on average) when compared to aluminum and PET, the total mass of materials shipped per mile is significantly higher, resulting in comparatively higher transportation impacts.

Recycled Content

Every 1% of recycled glass cullet added to primary glass results in a 0.4% reduction in energy requirements in the manufacturing stage.62 Since the majority of impacts occur in glass manufacturing, the life cycle environmental savings associated with glass recycling are actually quite low, as further explored in Figure 8.

Water Impacts

Since glass manufacturing does not rely on hydroelectric power, the main life cycle water impacts come from indirect water use associated with the transportation and distribution sector that are not directly related to glass production.

60 AGC Glass Europe. (2020). 61 Glass bottle conditioning refers to the process of reheating and slowly cooling bottles once they are blown to strengthen the glass and reduce breakage. 62 This energy reduction rate was used in the LCA model, based on the life cycle inventory data in RTI International. (2003). The assessment performed by RTI uses industry-specific sources. This is a high-end estimate, as several other sources say a 10% increase of glass cullet reduces glass manufacturing energy consumption by 2-3%: Testa et al. (2017).; Papadogeorgos, I., & Schure, K.M. (2019).

PET bottles

Introduction

Most environmental impacts in the life cycle of PET bottle production occur in the raw material extraction and resin production phase, with the second highest impacts in the manufacturing stage. See Figure 7 for a breakdown of where the main energy, water, and emissions come from in our model.

Functional Unit: Provision of 1000L beverage in 12-oz bottles, 0.019 kg per bottle, 6% recycled content (recycled content approach), 29% recycling rate (avoided burden approach). Use phase excluded from the scope of this assessment.

PET Bottle Life Cycle Hotspots

Raw Material Extrac-tion AND Production

The initial raw material extraction and resin production stage has the highest life cycle impacts, making up 52% of the total GHG emissions and 60% of total energy demand. This includes impacts associated with crude oil and natural gas extraction to the polymerization of the plastic monomer.63

Bottle Manufacturing

PET bottles are created through an injection molding process and subsequent heating and stretching with high-pressure air blows to produce large volumes of bottles with high precision. The electricity requirements of these molding processes, particularly stretch blow molding, explain the relatively high environmental impacts associated with this life cycle stage.

Water Use

While some water is directly used in the PET recycling process, the majority of the water impacts from our model are indirectly linked to upstream activities connected to electricity generation.

Recycled PET Impacts

Using recycled PET bypasses the impacts associated with raw material extraction and resin production. However, the manufacturing impacts for injection and blow molding remain the same.

63 These processes are all aggregated together in Ecoinvent life cycle data, which we used for our analysis. LCA practitioners have pointed out the general lack of data per life cycle step regarding PET, which hampers the robustness and reliability of many life cycle assessments. Refer to Gomes et al. (2019).

Key Model Assumption: Recycled Content

In many cases, the production of secondary material results in fewer impacts compared to the production and manufacturing of virgin materials, since secondary materials can bypass the upstream environmental impacts of raw material production. We tested our model using different recycled content ratios for each packaging type, revealing differences in environmental impacts with different amounts of recycled content.

Life cycle impacts for the provision of 1000L beverage in 12-oz bottles

GWP = Global Warming Potential | CED = Cumulative Energy Demand | WDP = Water Depletion Potential

From Figure 8, we see that aluminum cans show the greatest impact variability when recycled content assumptions are modified in our model. This is because the relative impact savings between producing primary and secondary materials in the aluminum system are much higher than the impact savings of increasing recycled content for the other packaging types. When compared to primary aluminum, recycled aluminum has a 93% reduction in the overall GHG emissions and respective 92% and 86% reductions in renewable and fossil-based energy demand, resulting in significant impact differences when the recycled content assumptions change.

Glass and PET bottles tell very different stories. For PET bottles, we see a consistent reduction of environmental impacts for GHG emissions and energy demand, but small reductions for water consumption. For glass bottles, the increased use of glass cullet in the manufacturing of containers displays relatively low environmental benefits, since the high energy demand linked to the manufacturing phase – the most burdensome life cycle stage in glassmaking – decreases marginally when using recycled glass cullet compared to virgin glass. As mentioned previously, for every 1% of cullet added to primary glass, only a 0.4% reduction in energy requirements in the manufacturing stage is reached.64 Furthermore, the energy reduction impact of increased recycled glass cullet is largely overshadowed by the increased emissions associated with transporting recycled cullet back to furnaces for remelting.65

This reaffirms the importance of setting up local processing and reuse options for glass bottles. By extending the lifespan of glass bottles and circulating the packaging material at its highest and best value, the burdens of glassmaking are able to be distributed through several use phases based on its “return” or “trippage” rate. According to an LCA study comparing carbonated soft drinks in the U.K.,66 a 0.75L glass bottle trippage rate of 3 cycles has the potential to equalize the impacts associated with glass manufacturing compared to 0.33L aluminum cans and 0.5L PET bottles. Although this estimation may be different for the U.S. system, where the distribution distances are vastly larger than those in European countries, reusability seems by far the most effective circular strategy to attain environmental savings for glass bottles.

While increasing the amount of recycled glass cullet in glass containers can have life cycle benefits from reducing primary material demand and reducing glass manufacturing impacts, it is a suboptimal circular strategy that plays at the margins of the true circular potential for glass: reuse.

Recycling glass is a suboptimal circular strategy that plays at the margins of the true circular potential for glass: reuse.

The challenge will be for glass packaging manufacturers and beverage producers to set up localized glass bottle collection, sterilization, and reuse systems that can minimize the transportation and distribution impacts of transporting empty glass bottles. Once glass bottles can no longer be reused, these materials can be collected for recycling and turned back into new glass bottles – ideally collected separately from other materials to minimize risk and contamination of broken glass in the sorting process. A combination of reuse and recycling of glass will maximize the impact reduction potential and minimize raw material demand in a fully circular beverage container system.

64 As noted, this is a high-end energy savings estimate based on glass life cycle inventory data (RTI International, 2003). Other sources cite 2-3% energy savings for every 10% of extra cullet added to the glass manufacturing process. Testa et al. (2017).; Papadogeorgos, I. & Schure, K.M. (2019). 65 Our model assumes an equal 500-mile transportation distance from the treatment facilities where the packaging materials are recovered and subsequently distributed back for remanufacturing for all packaging types. Glass cullet that is transported less than 500 miles will likely see marginal improvements in life cycle emissions impacts, which highlights the importance of localized strategies for material recovery. 66 Amienyo et al. (2013)

03 U.S. Recycling System Assessment

Now that we’ve assessed the design considerations and production impacts of these beverage containers, let’s see how each of these materials is currently being handled in the U.S. waste management system.

How are these packaging types currently being collected and processed in the U.S. recycling system, and what are the barriers to achieving a reliable stream of recycled materials that can compete with raw material production?

The recycling process in the United States is complex, with each state and municipality having a different system to collect, sort, and process recyclable materials. Some municipalities have curbside collection of recyclables, either through single-stream or multi-stream collection systems.67 While single-stream systems are easier for households to put all recyclable materials in one bin, these systems typically have higher contamination rates compared to multi-stream separate collection systems. Municipalities in rural areas usually rely on drop-off services to collect recyclable materials for reprocessing. According to the 2020 State of Curbside Recycling Report,68 59% of U.S. households have access to curbside recycling services, and only 6% of households do not have access to any recycling services (Figure 9). However, having access to recycling services does not directly correlate with actual material collection rates, which underscores the importance of providing convenient and incentive-based recycling systems for consumers.

Collection rates of different material types differ state-by-state, particularly for aluminum cans, PET bottles, and glass bottles. Ten states have implemented bottle bill policies, which put a 5- to 15-cent deposit on beverage containers. Customers receive this deposit back when they return cans and bottles to redemption centers. This provides an economic incentive for increased recycling, and it also creates cleaner recycling streams compared to single-stream recycling systems. The Container Recycling Institute estimates that these bottle bill states are responsible for recycling 46% of all containers,69 while only making up around a quarter of the U.S. population. It’s clear these bottle bill redemption states are an important source of high-quality recycled beverage container materials.

Visualizing Material Flows

One way to better understand how each of these materials is currently being handled in the U.S. waste and recycling system is to assess and visualize each step of the process in a material flow analysis (MFA). Our beverage container MFA draws on data from 2017, since this was the most recent year with publicly available data for all three packaging types.70 Figure 10 shows the MFA results scaled to 100% for each packaging type, which allows us to compare material recovery rates across the different material types. Figure 11 shows the same data scaled to the market mass for each packaging type, which allows us to compare the actual amount of material being collected and processed in the system. You can read the MFA from left to right to track each beverage container as it progresses through the system, from collection and sorting through processing materials for recovery.

In our assessment, we’ve split the collected materials into two groups: 1) materials collected through the bottle bill deposit system, and 2) materials collected separately from trash (referred to as “separately collected materials” in this report), which groups together all other methods of collection for recycling. For this model, we’ve treated all the separately collected materials as if they were collected and sorted in a single-stream recycling system, as this is the most common collection method for U.S. municipalities. Full MFA assumptions and sources are referenced in Appendix 2.

67 Damgacioglu et al. (2018). 68 Mouw et al. (2020). 69 The Container Recycling Institute. (2020). 70 We based our analysis on the industry-reported material generation and recycling rates according to the U.S. EPA for each packaging type in 2017. The glass container mass was adjusted to remove glass food packaging, using shipping report data from the Glass Packaging Institute.

Unit: million pounds of material.

Putting Recycling Rates in Context

We used the industry-reported recycling rates for each beverage container as the starting point in our analysis.71 In 2017, these recycling rates were 45.1% for aluminum cans, 39% for glass bottles, and 29.1% for PET bottles.72 However, just looking at recycling rates doesn’t tell the full story of the recycling system. It’s also important to see how much material is being lost in the sorting and recycling process, and to better understand whether the materials are being processed in a way that allows for materials to be used in high-quality secondary material markets to maximize impact reduction potential and compete with primary material production.

The aluminum can recycling rate refers to the amount of shredded used beverage cans (UBCs) that are ready for remelting – shown in the MFA under the “processed materials” category. In comparison, the glass and PET recycling rates are reported as the amount of sorted material ready for processing, shown under “sorted materials.” Already, we see that the material recycling rates don’t show the full picture, as one-third of PET material is lost in the mechanical recycling process, and 40% of the glass material collected from single-stream recycling systems is used as landfill cover.73 Neither of these material losses are accounted for in the reported recycling rates, which do not factor in the efficiency of recycling or whether recycled materials are used for high-value applications. This highlights the importance of assessing recycling rates from a full systems perspective.

71 Industry-reported recycling rates refer to the recycling rates submitted to the EPA by the Aluminum Association, Glass Packaging Institute, and NAPCOR each year. 72 While 2017 represents a lower than normal consumer recycling rate for aluminum cans at 45.1%, this was the most recent year where both glass and PET data are also publicly reported by industry groups to the EPA. 73 NAPCOR & APR. (2018).; Damgacioglu et al. (2018)

Aluminum Can Recycling Insights

Of the three material types, aluminum cans have the highest circular performance in the current U.S. recycling system. When considering sorting and processing losses, nearly 82% of UBCs entering the U.S. recycling system can be recovered for high-quality closed-loop recycling.74 In addition, some UBC material is captured after incineration, adding an additional 132 million pounds of material (5% of total aluminum can production) to the open-loop recycling market each year.75

Once cans enter the recycling system, the largest material losses occur in the sorting stage at material recovery facilities (MRFs), where up to 25% of UBCs can be missorted into other material streams or lost in the sorting process.76 Some facilities and downstream recyclers have additional eddy currents installed to capture this lost value from missorted UBCs, which represent one of the most valuable commodities in the recycling system. In fact, while UBCs only represent about 2% of material coming into sorting facilities by weight, aluminum cans represent nearly a third of MRF revenues in non-deposit states. The revenue from UBCs is vital for many MRFs in the United States to operate.77

While the sorting efficiency for UBCs is lower than the other material types, the purity of sorted UBC bales is relatively high (around 91%),78 which means the material bales can be sold and reprocessed at a high value. According to the Container Recycling Institute, around 40% of recycled UBCs are collected through bottle bill deposit systems,79 which are pure material streams that bypass the sorting phase. Once collected and sorted, UBCs are shredded at nearly 99% efficiency and are remelted at a 95.6% efficiency.80

Glass Bottle Recycling Insights

When factoring in sorting and processing losses, an estimated 59% of glass collected in the U.S. recycling system (from both deposit and non-deposit sources) can be turned back into glass bottles for closed-loop recycling.81

In 2017, the glass bottle recycling rate was reported at 39%, which represents the total amount of glass available through both bottle deposit and separate collection systems. These two different collection methods result in vastly different material quality streams for glass. 97% of the glass recovered through bottle deposit systems can be used for high-quality purposes, whereas on average only 40% of the glass collected in single-stream recycling systems is recovered for high-value reuse. Of the remaining glass collected in single-stream recycling, 40% is typically used as landfill cover and 20% is downcycled as an additive in construction processes.82 Downcycled glass used in construction will be impossible to recover again for continued high value reuse. High-quality sorted glass, which primarily comes from deposit systems, can be turned back into glass cullet for continued use in glass bottles or fiberglass at a 90% processing efficiency.83

Collecting and sorting glass is particularly difficult in single-stream recycling systems, since broken glass can damage machinery and small pieces can contaminate other recycling streams.84 In addition, while the glass breaker screen is 95% efficient at separating out glass in the sorting process, the purity of sorted mixed glass is only around 70%.85 This high amount of contamination, combined with the high cost of transporting glass, means MRFs often lose money from collecting and processing glass for recycling.86

These difficulties associated with glass recycling further highlight the importance of prioritizing localized and robust systems for glass bottle reuse. Reuse systems are the best way to maximize the true circular potential of glass bottles, as long as the system is designed in a way to minimize emissions from transportation and distribution logistics.

PET Recycling Insights

The 2017 recycling rate for PET bottles was reported at 29.2%,87 representing the total amount of PET available for processing after collection and sorting. Since PET is processed into rPET at 67% efficiency,88 the actual amount of rPET flakes available for open- and closed-loop recycling is around 20% of the total market mass, or 1,160 million pounds. Of this material, 21% is used for food-grade purposes, and the remaining 79% is used for other non-food grade applications, with most being used to create polyester fibers for clothing. While these open-loop material uses for rPET can reduce demand for primary PET in the short term, products such as fibers and films are less likely to be recycled at the end of their useful life compared to PET bottles, resulting in a linear system in the long term.

According to the Container Recycling Institute, an estimated 55.5% of PET bottles are collected via deposit systems,89 and the remainder are separately collected. When accounting for the 85% sorting efficiency for PET bottles at MRFs, along with the 67% processing efficiency from the recycling process, an estimated 13% of collected PET is used for food grade applications.90

Deposit systems are the best way to ensure PET can continue to be used in closed-loop food grade applications and generate enough market mass to meet recycled content goals. In states that do not have bottle bill legislation, the PET recycling rate hovers around 14%. In comparison, states that have enacted bottle bill legislation have a PET recycling rate of around 60%.91 It’s clear that bottle bill systems work – by putting value on what many consider waste, consumers have an incentive to collect and return materials for continuous circulation. That’s the best way recycled PET bottles can circulate at their highest and best use while amassing enough material to compete with virgin PET production.

Setting up a bottle bill system across the country would improve recycling rates for the other container types as well. Glass bottle recycling increases from 14% in non-deposit states to nearly 65% in deposit states.92 Aluminum can recycling rates jump from 35% to over 76%. But in terms of high-quality material recovery, PET bottles benefit the most, since bottle bill deposit systems provide a trackable source of verified food-grade PET bottles that can continue to be circulated at their highest and best use, rather than entering the general recycling system to be recycled one more time before ultimately being disposed of.

74 Calculated from the MFA: Recycled aluminum ingot mass (1150 MMlbs) divided by the mass of aluminum collected in deposit and separate collection systems (488+915 MMlbs). 75 Based on our conversations with aluminum can manufacturers and our literature scan, aluminum recovered from incineration is less likely to be used as recycled content for aluminum cans and is more likely to be used in other cast alloy aluminum applications. Gökelma et al. (2019).; Allegrini et al. (2015).76 See the 2020 Gershman, Brickner, and Bratton (GBB) report for a full analysis of where and how aluminum cans are lost in the material recovery process. Simmons, S. (2020). 77 Ibid. 78 Damgacioglu et al. (2018). 79 The Container Recycling Institute. (2020). 80 PE Americas. (2010b). 81 Calculated from the MFA: Glass cullet mass (3460 MMlbs) divided by the mass of glass collected in deposit and separate collection systems (2730+3150 MMlbs). 82 Gitlitz, J. (2013).; Majdinasab, A., & Yuan, Q. (2019).; Damgacioglu, H., Perez, L., & Celik, N. (2018). 83 Franklin Associates. (2018b). 84 Damgacioglu et al. (2018). 85 Ibid. 86 Jacoby, M. (February 11, 2019). 86 Jacoby, M. (February 11, 2019). 87 NAPCOR & APR. (2018). 88 Ibid. 89 The Container Recycling Institute. (2020). 90 Calculated from the MFA: Food grade rPET flakes (244 MMlbs) divided by the mass of PET collected in deposit and separate collection systems (1030+829 MMlbs). 91 The Container Recycling Institute. (2020). 92 Ibid.

04 Intervention Scenarios

How does each packaging type respond to key system interventions within the U.S. recycling system?