The Missing Trillions

Unlocking finance solutions to combat climate change: The Missing Trillions movement and event series.

Unprecedented Investment and Implicit Tension

A decarbonized global economy requires a sustainable pace of unprecedented investment. Financial institutions are committing capital to financing sustainability by 2030: Goldman 750B, Citigroup $1T, and Barclay’s $1T. And this is just investment banks. Private equity, insurance, venture, philanthropy, and the public sector are forging ahead, investing $1.8T in 2023.

Although there’s been rapid growth, we are still far short of the $4.5T per year needed to stay within a 1.5°C pathway consistent with the Paris Agreement (IEA, 2023).

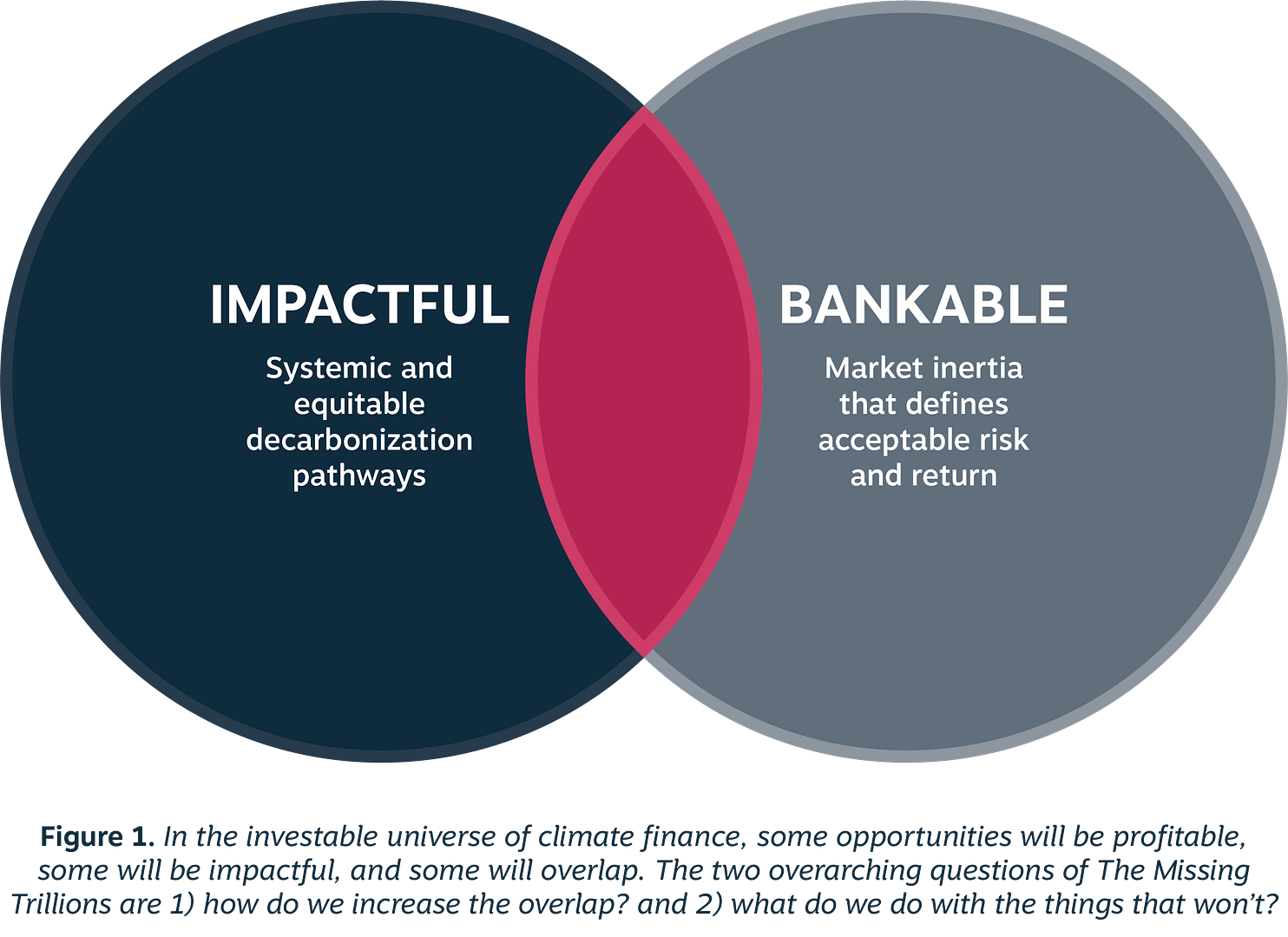

The challenge is an implicit tension between impactful and bankable projects. There has been extensive research and writings around methods that push the circles together and forces that pull them apart. But there will likely always be areas that do not overlap.

An Event Series: Embark on a Journey

The Missing Trillions event series is designed to challenge assumptions and reshape mindsets. Together with our partners and the global community, we are diving deep into the hidden handbrakes that impede the flow of climate finance. Our mission is to create actionable hypotheses that break down structural barriers, refined with input from global actors, to form a coordinated systemic action plan. By spanning multiple gatherings across the year, we aim to create moments of continuity and accountability where we collectively track progress on commitments that have been made.

This series spans key global events:

The Missing Trillions: Preparatory Meeting

At Climate Week NYC ‘23, we began the series by convening stakeholders to co-create the most impactful event format and approach for the series.

The Missing Trillions: Announcement

At COP28 in Dubai, we convened stakeholders to announce the initiative and begin to explore diagnoses of the problem.

The Missing Trillions: Root Causes

At Davos 2023, we examined systemic barriers to accelerating climate finance in dialogue with selected experts and a curated group of financiers, implementers, and enablers.

The Missing Trillions: Breaking Down Barriers

At Climate Week London ‘24, we shared the process of identifying opportunities and translating them into a prospectus format to help mobilize capital.

The Missing Trillions: Taking Action

At Climate Week NYC ‘24, we will share the results of the open call and refine action pathways. Actors will commit to the pathways whose results will be shared at the next event.

Date

September 26th, 2024

Where

Civic Hall

Save the Date: New York

Join us at The Missing Trillions event organized for the 2024 New York Climate Week, for a structured exploration of systemic risks and opportunities in climate finance.

In the final event of this year-long series, we will share insights on emerging, high-leverage, yet currently largely overlooked approaches to addressing the acute climate finance gap.

We will deep dive into 4 promising solutions with expert practitioners to identify new pathways for collaboration and scale. Participants will be invited to share promising initiatives they are working on and make calls for collaborations.

Over the past year, The Missing Trillions has been exploring overlooked leverage points that can accelerate the climate finance gap. During this time, it has developed a process and convened working groups to identify high-leverage investments interventions at the intersection of systems thinking and transition finance. Our methodology uses systems thinking to develop actionable strategies that resonate with a broad spectrum of capital: public, private, and philanthropic.

Our insights to date will be opened to the public for critical feedback, partnership development, and implementation pathways ahead of this New York Climate Week event

“Climate funding tends to go to the most straightforward projects, such as wind and solar farms, or electric vehicle charging infrastructure. But those are not necessarily the type of investments that will drive the structural changes to move us toward a fundamentally equitable and decarbonized economy.”

— Eva Gladek, CEO and Founder of Metabolic

What happens next?

Following our engagements at COP28 and Davos, we convened three thematic working groups to develop systemic interventions: Transition Governance, Project PIpeline, and Capital Formation.

Thanks to the efforts of our dedicated working group members, we have compiled an “Intervention Library”. At London Climate Action Week ‘24, together with our Systemic Climate Action Collaborative partners IIED, Reos Partners, Climate-KIC, Dark Matter Labs with support from Atölye and UN High-Level Climate Champions, we outlined this process and presented three interventions as case studies.

These prospectuses, creation methodology, and intervention library were opened to the public for critical feedback, partnership development, and implementation pathways.

At Climate Week NYC ‘24, Wednesday, the 26th of September, we will present the outcomes of our collaborative efforts and methodology to mobilizing investment coalitions around mutually-developed interventions.

Demand Construction

Methods to accelerate project-side enablement, knowledge equity, and market signaling.

Transition Governance

Designing policies and social structures that distribute rather than concentrate benefits.

Capital Formation

Scaling and modifying understood structures and instruments to speed primary issuance and secondary liquidity.

Learn More

Sustainable finance is key to a resilient future. For the past decade, our Finance team has helped institutions functionally integrate ecological risks into the balance sheet.

Learn more about the Systemic Climate Action Collaborative, a new initiative to create prosperous, inclusive, climate resilient societies.