Sustainable finance

Sustainable finance creates a resilient future.

Through availability of credit and cost of capital, the finance sector shapes the structure of the economy. We believe in Circular Finance, capital that flows to create systems where people and nature thrive. To get there, our Sustainable Finance team operates with two primary strategies: engaging across sectors and engaging the finance sector directly.

By engaging across sectors, we provide expertise to enhance circularity and sustainability across all of Metabolic’s entities and clients. In contrast, direct engagement with the Financial Sector involves direct consultation on Due Diligence, Impact Measurement, and Financial Structuring.

We work with pioneering financial innovators to shape the economy of the next century. We know that in new risks lie new opportunities. By avoiding Value at Risk (VaR) and pursuing Systemic Investing through delibrate portfolio construction, we guide investments towards new circular economic opportunities.

Are you ready to take the next step toward a decarbonized global economy?

Or go beyond, and be at the cutting edge of systemic transformation, towards a society that operates within planetary boundaries?

Whether you seek to enhance circularity across sectors or require direct consultation on Due Diligence, Impact Measurement, and Financial Structuring, our expertise is here to guide you. Join the ranks of pioneering financial institutions and innovators who are shaping the future economy. Start your journey with us today by exploring high-leverage investments that align with systems thinking and transition finance.

featured

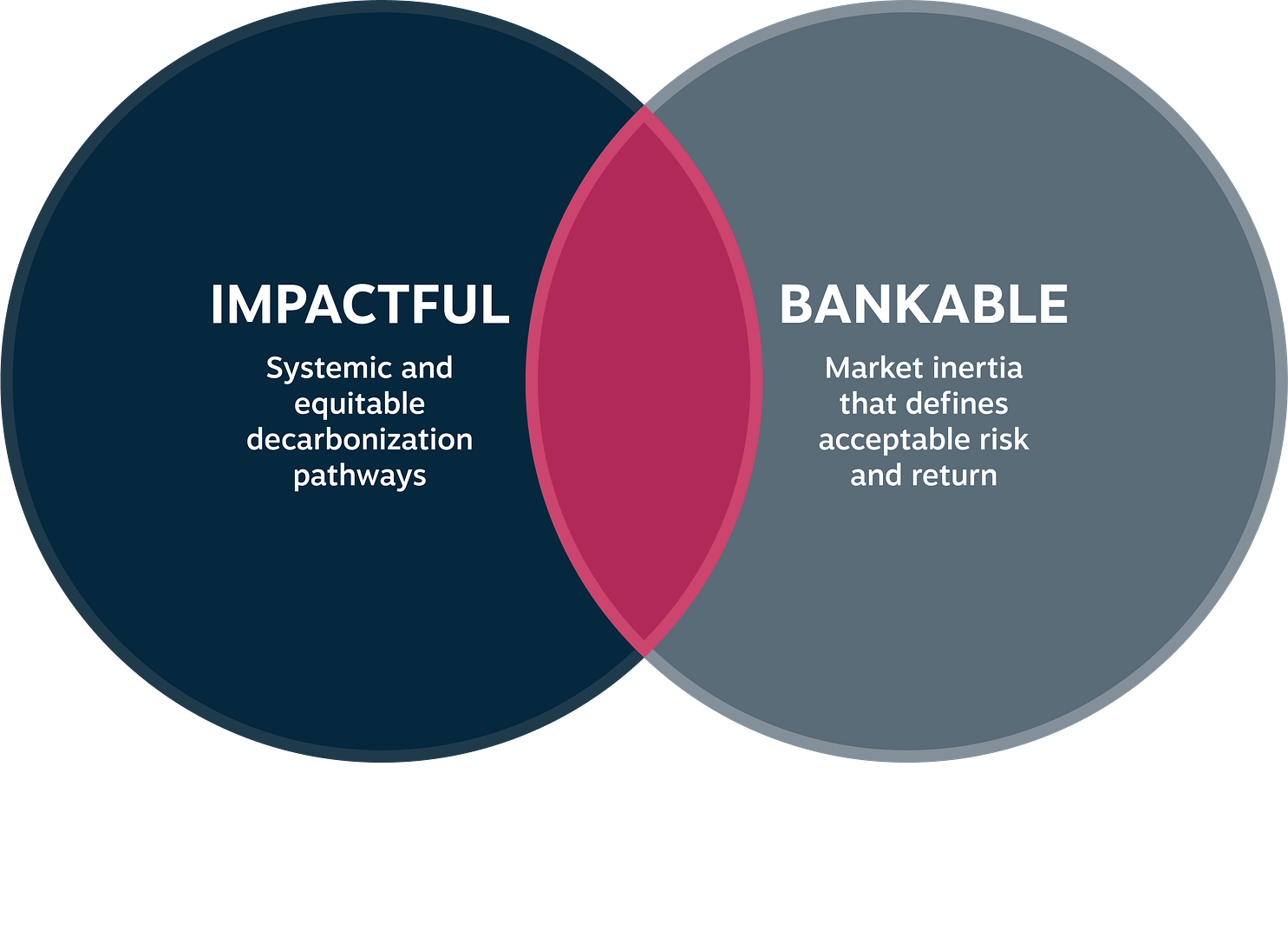

The Missing Trillions is an initiative aimed at driving systemic risks and opportunities in climate finance. Join us as we share a process to identify high-leverage investments at the intersection of systems thinking and transition finance. Our methodology uses systems thinking to develop actionable strategies that resonate with a broad spectrum of capital: public, private, and philanthropic.

We aim to forge new connections and enact practical strategies to bridge the climate finance gap.

We work across sectors

We work with financial institutions in the transition to a circular and sustainable economy. We work with clients on systems mapping, analyzing barriers, and discovering interventions. With over a decade of experience, we help companies understand their climate impact, develop sustainable procurement strategies, and analyze material flows to create effective net-zero and circular economy roadmaps. Connect with us

Project Preparation

In Project Preparation, we estimate the financial and impact benefits of proposed interventions. We assess circular scenarios for products and business activities, compare circular and linear business models, and evaluate implementation costs. This results in a circularity scorecard for benchmarking and improvement.

Implementation

Post-transaction, we oversee the implementation, operations, and reporting of interventions. Reviews and updates of the financial and impact performance of these interventions, pave the way for discovering additional opportunities. This process creates an invaluale library of performance data.

Systemic Investment Advisory

We engage directly with financial sector clients, offering services in Due Diligence, Impact Reporting, and Financial Structuring.

Impact Reporting

We provide a comprehensive understanding of impacts, risks, and opportunities. Our Impact Reporting services aggregate and assess environmental impacts, providing valuable insights for financial decision-making.

Systemic Investing & Portfolio Design

Systemic Investing focus on designing multi-asset portfolios that combine infrastructure, small-to-medium enterprises, and ventures to pool risk, return, and impact. We also advice on integrating financial instruments such as Loan Guarantees, supporting the development of blended finance models and systemic portfolios.

Outcomes from Working with Us

Model Interventions & Projects: We develop financial models for a wide range of interventions and projects across various sectors, showcasing their financial viability and impact potential.

Gain Market Understanding: We conduct comprehensive due diligence for financial sector clients, integrating circularity thinking into financial operations and decision-making processes.

Support Due Diligence: We provide due diligence support for systemic investment advisory projects, ensuring financial decisions align with sustainability goals.

Assess Transition Plans: We validate transition plans for clients, qualifying them for consideration in emerging funding areas such as transition finance.

Team

Projects

Indicators for Sustainable Real Estate Investment

Developed an indicator framework to automatically assess the environmental and social performance of real estate investments at ABN AMRO Real Estate.

Playbook for Systemic Portfolio Construction

Developed a playbook to build Place-based Transition Funds that combine infrastructure with a minority positions of small-to-medium enterprises and ventures. The portfolio pools risk by using loan guarantees to wrap 5-10 related investments and deliver strong risk-adjusted returns for investors. This location-based portfolio offers customizable investments and philanthropic opportunities, based on their risk-return-impact preferences.

Sustainability Indicators for Organizational Performance

Developed a test set of indicators for Dutch pension fund PGGM to evaluate their portfolio on science-based targets for sustainability and circular economy performance.

A Sustainability Strategy for Amvest Capital

Developed a sustainability vision with measurable indicators and a strategy to contribute to sustainability in the built environment over a portfolio of 20,000+ homes.

connect with us

We collaborate with industry leaders to design and implement financial strategies that drive systemic change. From the comprehensive support across sectors to the targeted expertise towards the financial sector, we provide the tools and insights needed to navigate the complexities of sustainable finance in an age of uncertainty, transition, and opportunity.

Engage with our expert team, leverage our cutting-edge tools, and be a catalyst for systemic change today.