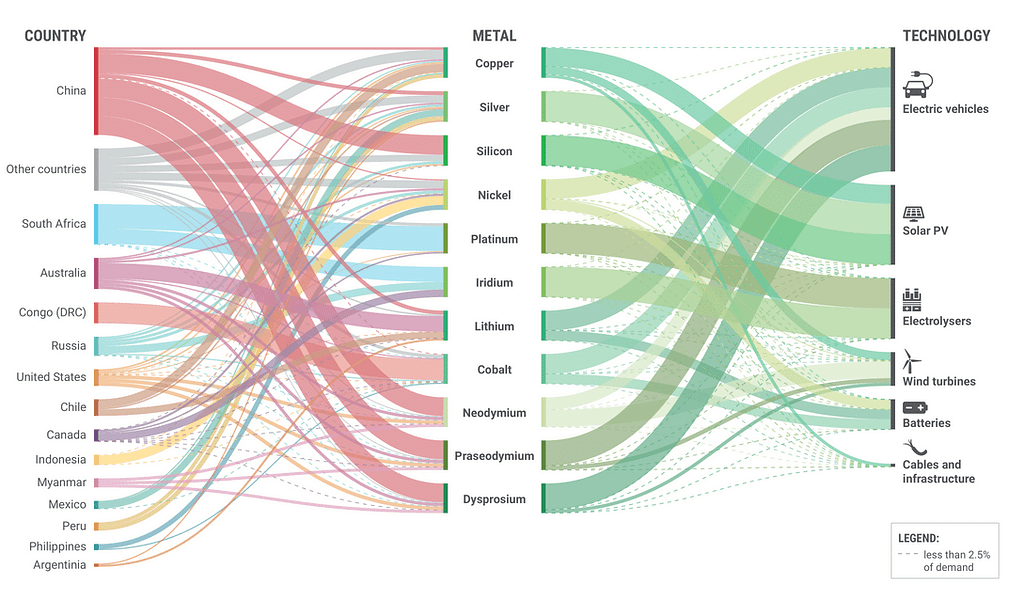

To transition to a renewable net-zero economy, we need vast amounts of specific metals to build out technologies like wind turbines and electric vehicles. But these metals, like cobalt, lithium, and rare earth elements (REE), are considered ‘critical’ thanks to their high economic importance and supply chains that are sensitive to disruptions. How can we secure a stable supply of these resources to build a sustainable economy?

To prevent a climate crisis and to meet the targets set at COP26, the Netherlands, and countries around the world are ramping up their efforts to cut global emissions. Renewable energy and sustainable transport systems are both expected to play a big role in the move towards clean energy. However, the availability of metals is a challenge, as solar panels, wind turbines, electric vehicles, and storage technologies all require certain critical metals. Demand will outpace supply if everything proceeds at its current pace. This lack of supply is becoming a global political issue, with the International Energy Agency’s report earlier this year recommending that policymakers ensure the supply of critical minerals, so they do not become a bottleneck in the accelerated transition to clean energy.

Here in the Netherlands, the government has set a goal of developing a net climate-neutral energy system by 2050, in accordance with the Paris Climate Agreement. To meet these goals, the country will need significantly more critical metals, such as lithium. Up to 15% of the current global lithium production would be needed by this single country. This is a huge proportion, especially when considering the Dutch share of global GDP (1.0%), energy consumption (0.5%), and population (0.2%).

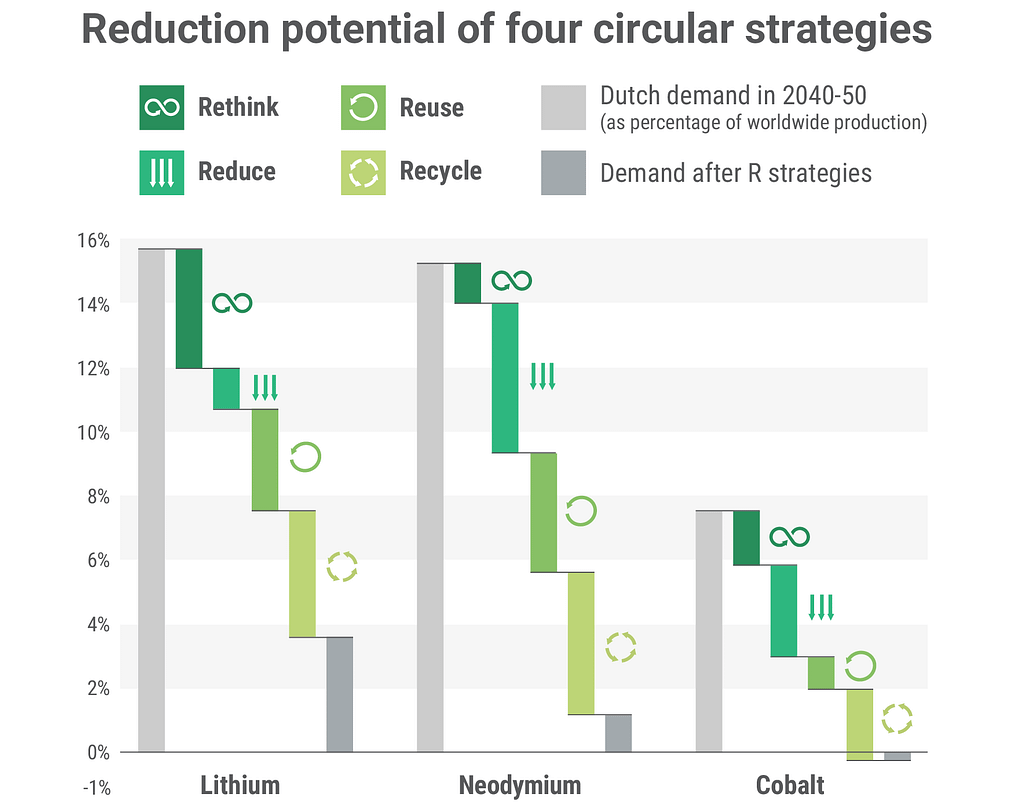

A recent report from our Industries team, along with our partners, Copper8, Polaris Sustainability, and Quintel, found that a four-part circular strategy can significantly reduce the overall demand for these metals, better ensuring future availability for the energy sector. The strategy is based on a combination of the four “R” principles: Rethink, Reduce, Repair, and Recycle.

- Rethink: adopting methods that save energy on a large scale and, where necessary, redesigning the energy system in a way that reduces the required sustainable generation, transport, and storage capacity of electricity.

- Reduce: shifting towards new technologies that contain less critical metals, such as in wind turbines or system batteries.

- Repair, refurbish & repurpose: extending the life of products and parts, such as reusing solar panels or batteries for electric vehicles.

- Recycle: recovering raw materials at the end of a product’s life cycle.

Adopting one strategy alone is not enough, the researchers emphasized in the report. A combination of all four will have the greatest effect in terms of an overall decrease in demand.

When combining the strategies, the report estimates that Dutch demand for lithium in 2040-50 would drop from about 15 percent of the current annual production, down to 3%. Each of the four strategies contributes to that reduced demand. (Cobalt would even see a surplus as we move towards cobalt-free battery technology over time while recycling older, cobalt-containing batteries.)

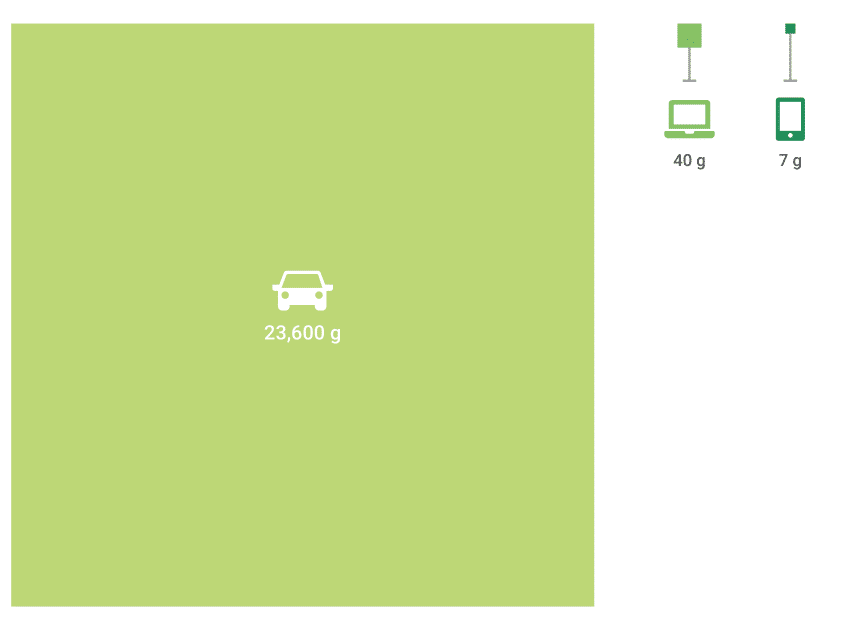

Other industries also use critical metals, but nowhere near to the extent that the renewable energy system requires. For example, an iPhone 6 contains about 7 grams of cobalt and 0.9 grams of lithium. Meanwhile, the battery (NMC111 60 kWh) of an electric car contains 23,600 grams of cobalt and 8,300 grams of lithium. One electric car requires as much cobalt as 3,300 iPhones. In one possible energy scenario for the Netherlands that requires the lowest amounts of metals, the expected lithium demand between 2020 and 2050 is 130 to 178 kt — this still equates to 144 billion iPhones, or nearly 8,500 iPhones per person.

And these figures just show the effects in one, small European country.

“All the findings and results and solutions that we’ve applied to the Netherlands all apply to the global energy transition,” said Pieter van Exter, one of the report’s authors and the lead of our circular industries team. “We chose the Netherlands as there is a really concrete roadmap for delivering and building the future energy system, so that makes it really tangible. But all the lessons learned, the scale of the problem, the exponential trends that we see, and also the ways to mitigate risks and secure our future resources, all apply to the global system.”

Our researchers also made recommendations to guarantee the security of the supply. They recommend establishing a system for permanent monitoring and continuous knowledge development and increasing the transparency of international supply chains. These would help to better understand the environmental and social impacts of critical metals, and to reduce those impacts. Additionally, our team recommends developing a long-term industrial policy that directs investment decisions and setting stricter laws and regulations that promote high-quality materials reuse. These preconditions are especially important in the Netherlands, which has little industrial activity related to critical metals.

“The solutions that we are raising here really need to be addressed at the EU level or even at the global level to be successful,” van Exter said.

Thankfully, the European Union may be stepping up. The Commission has proposed new legislation to dramatically reduce the environmental impact of batteries bought and sold in Europe. These new standards support a general drive to increase EU battery production capacity, reducing the dependence on Asia. The European Raw Materials Alliance followed from the Action Plan on Critical Raw Materials to increasingly source critical metals from within the EU, or from close allies, with less environmental and social impact. This plan has not been without controversy, however. The mining industry has argued that sourcing materials from within the EU could incentivize the use of different batteries, potentially non-recyclable, and just as full of virgin materials. The Commission has addressed exactly this concern with proposed regulations requiring a growing proportion of recycled materials within new batteries, as well as minimum recovery rates for some of these critical metals.

Sourcing locally and recycling existing critical metals is a reasonable start. But as with the Netherlands, the EU could maximize the decrease in demand by combining multiple circular strategies.

Across the world, as the global demand for critical metals grows thanks to increased investments in sustainable technologies, the metals shortage will intensify. Adopting a combination of circular strategies to reduce the overall demand, while considering the availability of metals within policymaking, are vital towards a successful transition to renewable energies.