Systems modeling for measuring financial risks to ocean assets

Exploring sustainability pressures and financial risks to the Blue Economy with WWF, using a systems modeling approach in the Baltic Sea.

- Client: WWF

- Date: December 2019

Evaluating non-linear environmental risks

The Blue Economy – all economic activities related to oceans, seas and coasts – is estimated to be worth at least USD 24 trillion. However, the direct and indirect value generated by marine environments is increasingly under threat from environmental change such as rising sea levels, more frequent storms, changes in ocean temperatures, acidification, salinity and pollution. This poses a risk to assets and revenues dependent on a healthy Blue Economy. What is more, the risks posed by climate change and other human impacts are constantly changing, and they are deeply interconnected. While financial institutions have methods to evaluate these risks, many of these methods are not yet adequately equipped to handle the changing, interconnected, non-linear risks of multiple environmental factors acting on the Blue Economy.

A systems approach to financial risk modelling

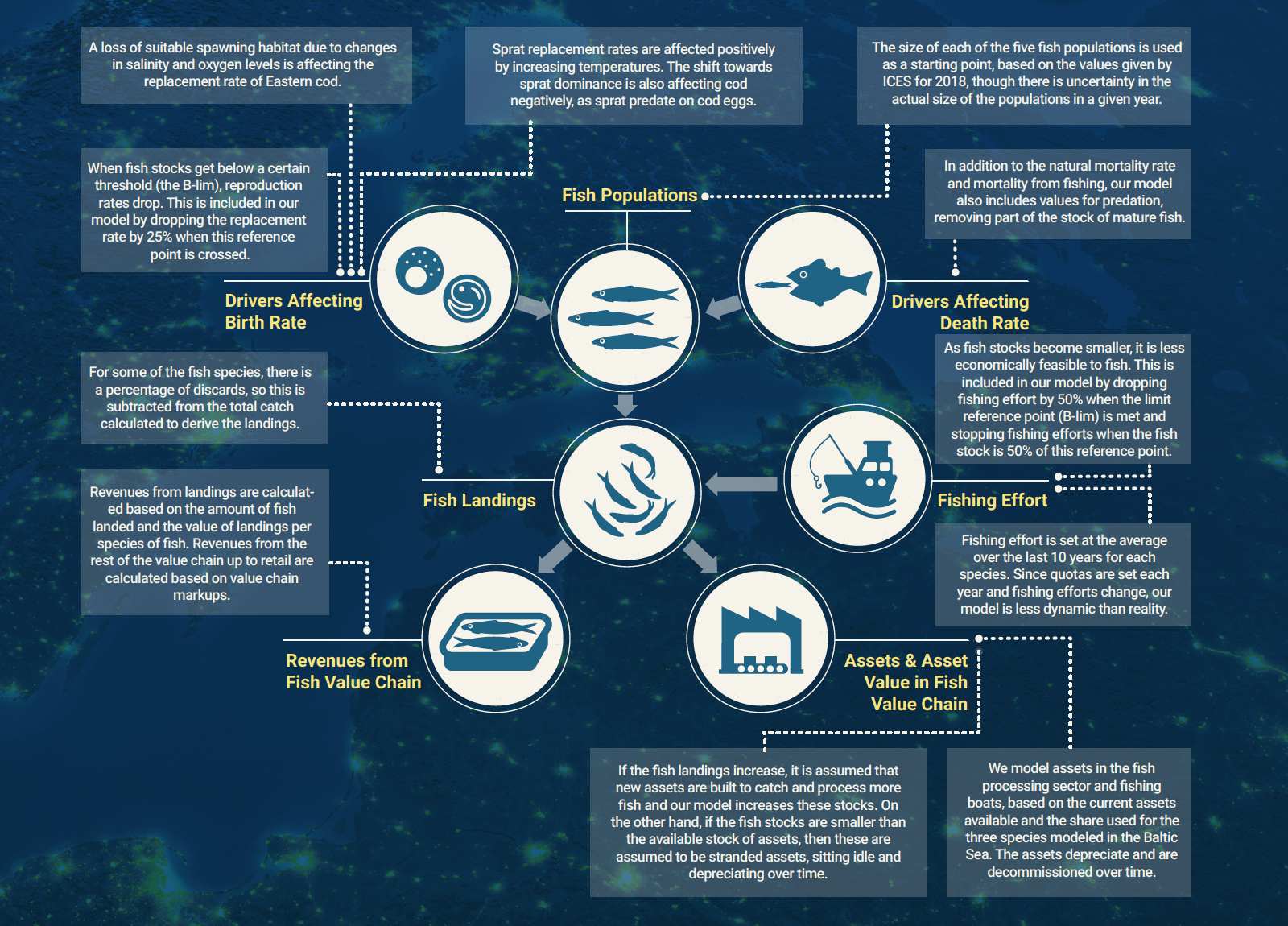

The goal of this project was to explore the feasibility and usefulness of modeling financial risk in the Blue Economy using a systems model approach. Focusing on the Baltic Sea as a case study, we developed systems-based Value at Risk models for two main sectors: ports and fisheries. A systems modeling approach to Value at Risk assessment begins with modeling the relationship between different variables in a system, taking into account how they influence each other. For example, fish stocks might be influenced by fishing quotas, but also the health of predator and prey species, water salinity levels, water temperature, pollution and acidification,. These environmental drivers are interconnected, and it is necessary to understand how each impact or driver influences the outcome of the overall system. The result is a more fine-grained, context-specific understanding of the interplay between environmental impacts and economic activity in a system such as the Blue Economy.

Opportunities to apply the approach in other sectors and geographies

The results from this pilot study revealed that systems analysis for Value at Risk assessment shows promise for further development. This type of modeling allowed us to incorporate elements that would not be possible using traditional Value at Risk approaches, including a concept of “point-in-time” risks like Extreme Sea Level events, cumulative impacts, and tradeoffs and interactions between different parts of a sector.

Our calculations indicated that the total (Value at Risk) VaR to the ports sector in the Baltic Sea region over 85 years is up to 2.21%, or €19.9bn, while the total VaR to the fisheries sector in the Baltic Sea region over 15 years is 73%, or €1.32bn. These results are higher than traditional risk modeling estimates, suggesting that a systems modeling approach reveals more potential risk to the Blue Economy than previously thought. With a successful pilot, we are able to apply this approach to further sectors, locations, and impact drivers, as well as to model different scenarios and understand the impact of risk mitigation strategies.

“Managing the physical and transition risks from climate change and other environmental impacts will be one of the investment community’s defining challenges this century."

Seadna Quigley, Circular Finance Lead, Metabolic