How can layered vegetables help us understand the risks of transformative ventures?

A Silicon Valley venture capitalist, a trip to a Sri Lankan market, and a botched attempt at a Sunday night Catalan meal lead us to understand the risks of building ventures aimed for transformative change.

Entrepreneurship is fundamentally risky. The chance of failure is higher than success. A well-known venture capitalist in Silicon Valley, Marc Andreessen, coined the “Onion Theory of Risk.” This is a way to understand how entrepreneurs can peel away common risks that their ventures face, bit by bit, like the layers of an onion. This theory was written with a high-tech, profit-focused enterprise in mind, typical of the Silicon Valley paradigm.

At Metabolic Ventures, our focus is on building transformative ventures that society needs. We call them systemic ventures, or you might also call them “transformative ventures” or “catalytic ventures.” Regardless of the name, what matters is their purpose and approach — to identify and play a critical role in the transformation towards a regenerative and just society. We talked more about this in our 2020 white paper, the Systemic Venture Framework, and 14 key questions for impact entrepreneurs.

Systemic venturing is an emerging approach to building ventures. It is not well understood, particularly the risks involved, which means it’s hard to accelerate its progress. If we can understand the risks, we can better mitigate them to make these ventures more successful, and hopefully spur more talent and resources to transition our economic system.

Click here to find the PDF for “The Artichoke Theory of Risk.”

Starting on page 7, you can find interactive elements on the icons and navigation bars.

Systemic ventures are rather different from the conventional ventures referenced by Andreessen. The onion doesn’t quite cut it as an analogy for the risks around a systemic venture. Instead, we propose the artichoke as a more suitable analogy due to its higher number of layers and complexity.

Why an artichoke?

While waiting at an airport, I listened to an interview with Marc Andreessen discussing the Onion Theory of Risk and realized it needed updating for Systemic Ventures. It took some time to find an alternative foodstuff. For months, in fact, I thought about what might have more layers than an onion and could represent the complexity of a systemic venture.

Finally, I was walking around a food market in Sri Lanka during a family visit and the answer struck me: the artichoke. This transported me back to a Sunday evening meal at a classic Catalan restaurant (Taverna El Glop), my first time pulling apart artichokes and dipping them in the local romesco sauce. (It would be rude not to mention the classic ‘calçots’ at this juncture, but that’s a completely different type of onion.) I struggled to navigate the complex and seemingly infinite layers of these artichokes.

Consider the artichoke. The edible part of the plant consists of the flower buds before the flowers come into bloom. Each bud has a unique shape that differs from plant to plant. The buds arrange themselves in a complex and interlocking way. The artichoke is multi-layered, idiosyncratic, and challenging to unravel.

While there is some variation between onions, they are consistent; we peel off one layer, then the next, and the next — that process does not change so much. The artichoke, on the other hand, has more layers in varying arrangements. Each time, we have to take different approaches to peel them away.

The artichoke thus reflects the systemic venture and its risks.

The Artichoke Theory of Risk Paper

In 2020, our Systemic Venture Building white paper outlined our wider approach to venture building. Since then, we have learned a lot through our work at Metabolic Ventures and Fresh Ventures.

This paper builds on our experiences and explores the potential pitfalls in building transformative ventures, offering strategies to avoid or address them. Ultimately, this paper has evolved into a primer on ‘how to build a transformative venture from scratch.’

There are three key aspects to this work:

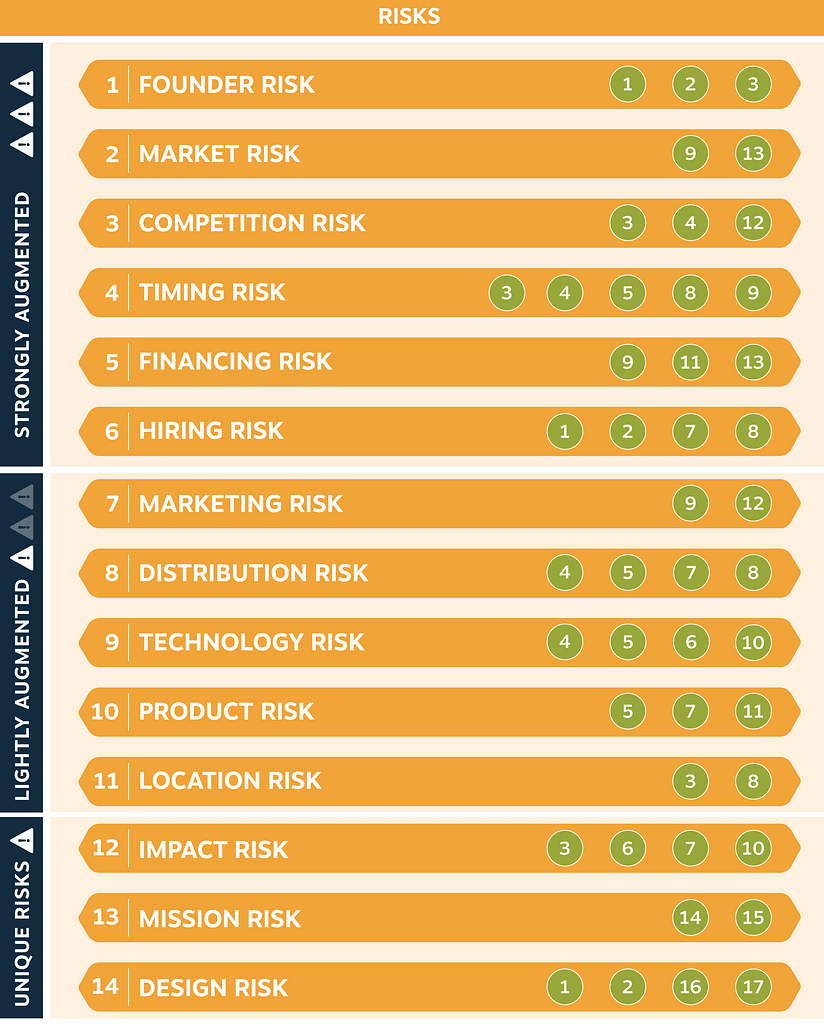

Risks: We identified 14 risks to consider when building a systemic venture. While 11 of these are common to any venture, six of these 11 are far riskier for a systemic venture compared to a traditional venture. Three risks are unique to systemic ventures.

Mitigations: We explored 17 different approaches we can use to mitigate these risks. These approaches can each address multiple risks simultaneously or focus on individual risks.

Timing: Specific risks come into play at different phases of a venture’s development. Entrepreneurs should prioritize key risks at each stage rather than addressing them all at once.

How to use the Artichoke Theory of Risk

We believe this paper can be a practical resource for entrepreneurs in the early stages of starting a systemic venture. It should help them better navigate the perils of building an ambitious enterprise. It also provides valuable insights for those who support these innovators, such as venture programs or innovative financiers.

We hope that this paper can be used more like an interactive tool rather than a one-time read. The key body of the work, focusing on risks and mitigations, are linked together and form a web-like structure. Readers should be able to jump around quite easily. For example, a venturer may first want to understand all the risks at play and determine what is most relevant to them now. They can focus on a few risks at the start and explore the relevant mitigations. Later, when facing a challenge, they can return to this paper to identify what mitigation actions could help.