Working with a razor-sharp focus on achieving their goals, mission-driven ventures are key to the transition towards a circular economy. However, unlike conventional startups, these ventures face an important challenge: how can they guard purpose over profit over time? The answer lies in rethinking ownership.

When working towards a sustainable goal, mission-driven entrepreneurs have the chance to bring new ideas into practice and spark economic, social, and environmental innovation. For this to happen, these entrepreneurs must be able to pursue purpose over profit. This can become a challenge when considering that conventional financial systems and ownership models often create an implicit conflict between the interests of founders and funders.

Mission-driven entrepreneurship needs different financing and ownership models that are designed to guard the mission and keep profits as means to an end, and not the end itself. Rethinking ownership will help us to achieve that transition.

Metabolic is exploring how this works in practice, both through our own ownership structure as well as with our newest venture, Fresh Ventures Studio, a venture generator and startup studio, which we will examine below along with other case studies.

Introducing steward-ownership

Ernst Abbe, co-owner of ZEISS, brought us a solution in the late 1880s. After the death of the company’s founder, Abbe decided to found the Carl ZEISS Foundation and make it the owner of ZEISS, a German manufacturer of optical systems and optoelectronics. In this way, he ensured that the company’s ownership could not be sold and that the profits would be used or re-invested in projects aligned with its mission. Abbe laid the basics for the structure we know today as steward-ownership.

Steward-ownership is an ownership and governance model that aligns the interests of entrepreneurs, workers, investors, and society. It is based on two principles: entrepreneurship equals ownership (the majority of voting rights are held within the company) and profits serve the company’s purpose (the majority of profits are either reinvested in the company and its stakeholders, or they are donated).

This type of structure is important because conventional financing tools and ownership models often do not work for mission-driven organizations for two reasons, says Seadna Quigley, Finance Director & Lead Circular Finance at Metabolic and co-founder at Fresh Ventures. “Firstly, excessive return expectations lead to unrealistic growth trajectories, leaving viable businesses without funding,” he says. These companies cannot become “unicorns,” startups that are valued at more than $1 billion, because that would require mission-driven companies to focus on generating returns rather than sustainable impact. “Equity financing is often also designed so that investors gain as much control over the business as possible,” Quigley adds. “This is counterproductive for mission-driven founders and could jeopardize the impact focus of the company in the long term when a company is bought.”

An innovative structure for founders, funders, stakeholders, and the planet

Steward-ownership changes how power is distributed — not according to investments or inheritance, but according to ability and value alignment. In practice, this model splits decision-making and profit-sharing rights. Founders and employees get exclusive decision-making rights, while investors do not, but in return get greater guarantees over dividends and other payouts. The advantage of this is that the organization can focus on fulfilling its mission, while still securing returns and liquidity for investors.

The benefits do not stop there. Various studies have shown that self-owned businesses not only outperform traditional for-profit companies based on profit margins, they also offer significantly more stable returns while having a higher survival rate.

When compared with conventionally owned companies, steward-owned ventures also report higher levels of employee satisfaction and customer trust. And because internal management handles decisions, ventures can better focus on their sustainable mission over the long run, benefitting society and employees’ best interests.

Steward-ownership in practice

More and more companies are exploring how they can implement a steward-ownership model. The principles may vary from venture to venture, adapting to the organizations’ needs and the local legal context. However different they may be, the underlying principles remain the same.

Let’s look at some examples of steward-owned ventures, and why and how they implemented this innovative structure.

Fresh Ventures Studio

Launching this year, our newest venture, Fresh Ventures Studio, will implement steward-ownership to safeguard its ultimate mission of transforming the food system. Fresh will build ventures that contribute to a regenerative and circular food system, and these ventures will be able to make a positive impact that’s not limited by the conventional way of building, structuring, and financing.

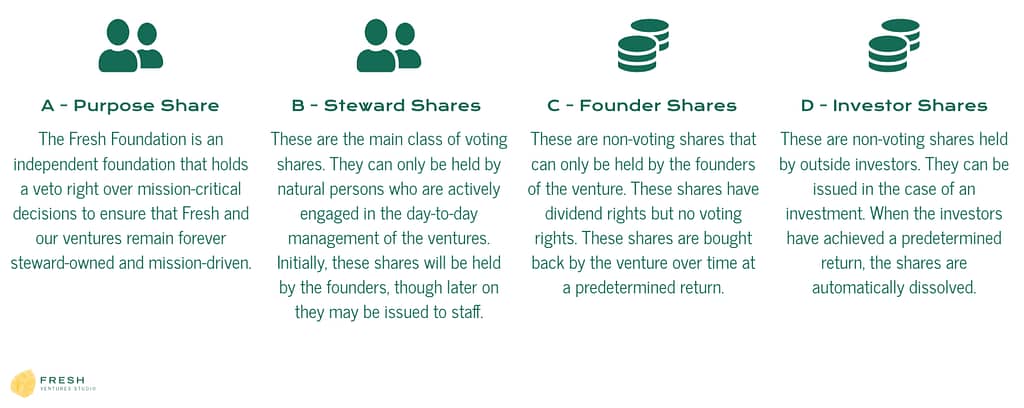

Fresh’s shares are broken down into a few classes, each with different rights and responsibilities:

An important component of Fresh’s steward-ownership model is how investors earn returns. Fresh is adopting revenue-based financing: rather than making an exit in future funding rounds, investors are repaid over time from a percentage of revenues, free cash flow, or gross profits, until they have achieved a predetermined return on their investment. At this point, their shares are automatically dissolved and the venture operates independently again. This will help it to maintain its attractiveness to investors, which have fewer rights than in conventional finance, and to align funding and stewardship.

Find more information about the program here.

Sharetribe

Sharetribe aims to democratize the ownership of sharing online platforms by making online marketplace technology accessible and affordable.

To guard its mission and avoid becoming one of the monopolizing platform giants of the sector, the startup has decided to adopt steward-ownership.

“For Sharetribe, steward-ownership means being able to give a binding promise to all stakeholders: we’ll never sell out the principle and purpose,” said Antti Virolainen, co-founder of Sharetribe.

The main aspects of their model:

- Similar to Fresh, Sharetribe recognizes several different share classes: A-shares and B-shares with voting rights, and C-shares and D-shares with profit-sharing rights. Respecting the “ownership equals entrepreneurship principle,” voting rights are held only by active team members.

- The company, or the majority of the voting right, can never be sold or taken public.

- Profit distribution and salaries are capped to prevent profit maximization. The people holding the ultimate decision-making power cannot divert all the money streams to their own pocket when the capital returns are reached.

- The structure is made permanent with a foundation. By issuing B-shares, also known as veto shares, and giving them to the Purpose Foundation, Sharetribe has made sure that the company will always remain a steward-owned company.

Wildplastic

On a mission to solve the plastic crisis, Wildplastic recovers world “wild” plastic waste from nature and then produces recycled trash and parcel bags. Turning the plastic problem into a solution requires time, so the purpose-driven venture has adopted the steward-ownership model to guard its long-term purpose, authenticity, and beliefs.

Wildplastic has adopted the golden-share model of steward-ownership. This means that 1% of Wildplastic’s voting shares is held by the Purpose Foundation to protect its ownership and financing structure. The financing partner provides non-extractive, mission-aligned growth capital to help the business grow. The rest of the shares are divided between investors, with dividends but no voting rights, and stewards, with 99% of voting rights and no dividend rights.

Curious to learn more? Watch this webinar by Fresh: