Value at Risk in the Global Blue Economy

How a system dynamics model can measure environmental pressures on financial risks

The blue economy contributes up to $24 trillion globally, but it is increasingly susceptible to complex environmental and socio-economic risks. Using a system dynamics model to capture these interacting and cumulative effects, we found that there is significant value at risk in a business-as-usual trajectory. We found that by adopting a more sustainable pathway, more than $5 trillion could be saved.

- Client: WWF

- Date: October 2021

Conventional risk valuation inadequate to capture nonlinear risks

The “blue economy” refers to industries that rely on the marine environment for commercial activities, such as coastal tourism, fisheries, and coastal real estate. The ocean contributes about $24 trillion to the global economy. However, value generated in the blue economy sector is increasingly susceptible to risks from complex environmental and socio-economic drivers, like sea-level rise, pollution, and ocean acidification. These drivers constantly change and impact each another, generating nonlinear risks that are difficult to predict.

The urgency of these interconnecting risks may not be clear in the short-term evaluations that the financial sector generally considers. Environmental risks are rarely, if ever, priced into the value of assets because they are either not viewed or they are interpreted incorrectly.

To address this challenge, Metabolic built a system dynamics model to capture the interacting and cumulative effects of environmental factors on financial returns.

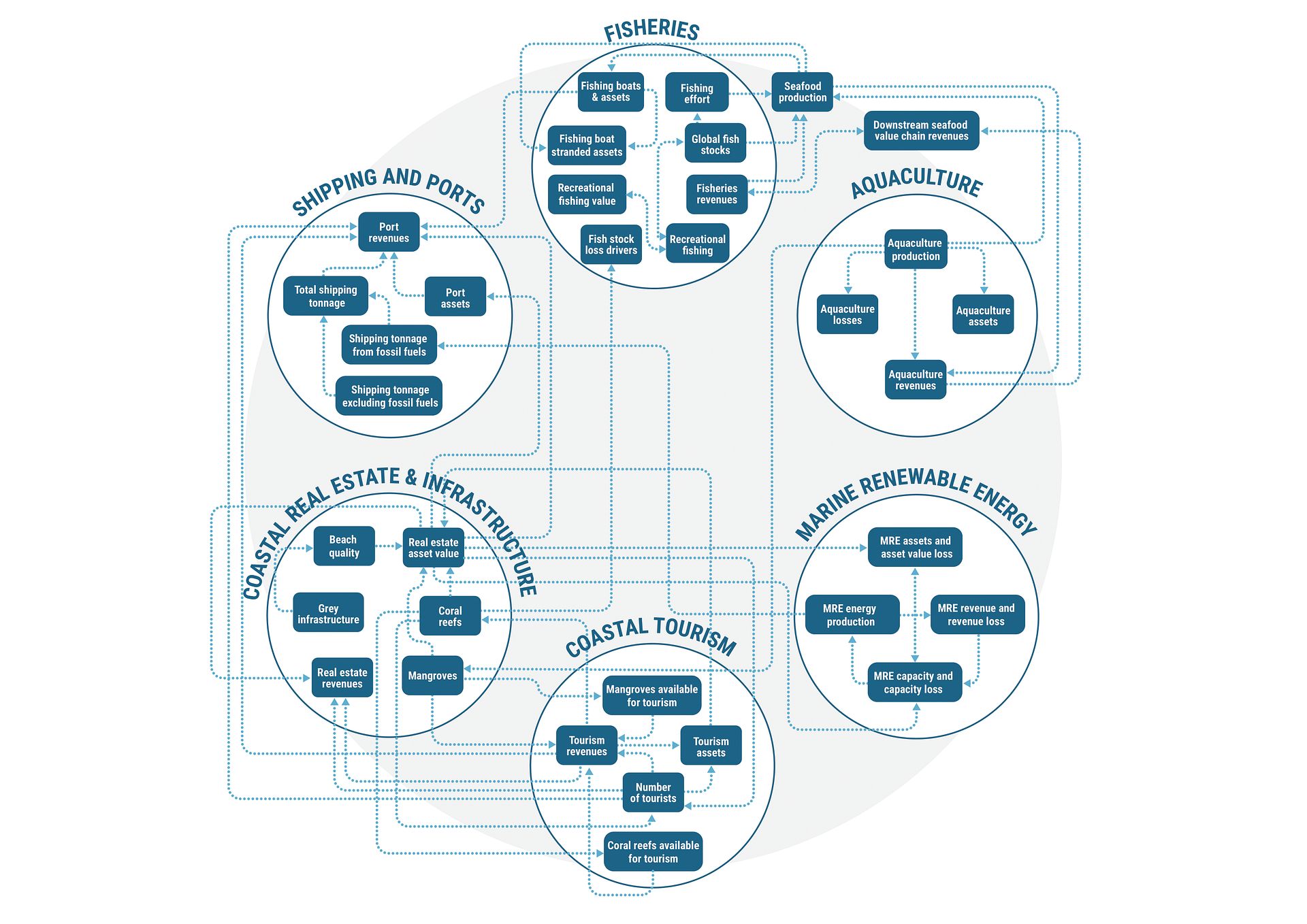

Building a system dynamics model for the blue economy

Using literature research and expert interviews, we mapped key causal relationships of different environmental, economic, and regulatory drivers that create risk for sector-level revenues and assets. Then we built the conceptual model using Stella Architect, a leading quantitative system modeling software. We calculated the sector-level Value at Risk (VaR) in two scenarios: business-as-usual and sustainable development. Finally, we translated the sector-level VaR into financial terms by allocating these impacts across the MSCI ACWI Investable Market (IMI) Index, which covers about 99% of the global equity investment opportunity set.

Opportunities to integrate environmental drivers into mainstream risk assessments

The system dynamics model allowed us to simulate feedback loops, tipping points, and tradeoffs in the blue economy, which are not captured in conventional risk valuation. For example, damaging fishing and aquaculture practices are detrimental to coral reefs and mangroves, which provide critical habitats for marine life and attract tourists. Decreased interest in tourism may lead to lost tourism revenue and slower appreciation of coastal property values. Therefore, understanding the interactions between commercial fisheries, coastal tourism, and coastal real estate is crucial in accounting for, and mitigating, the financial risks in these sectors.

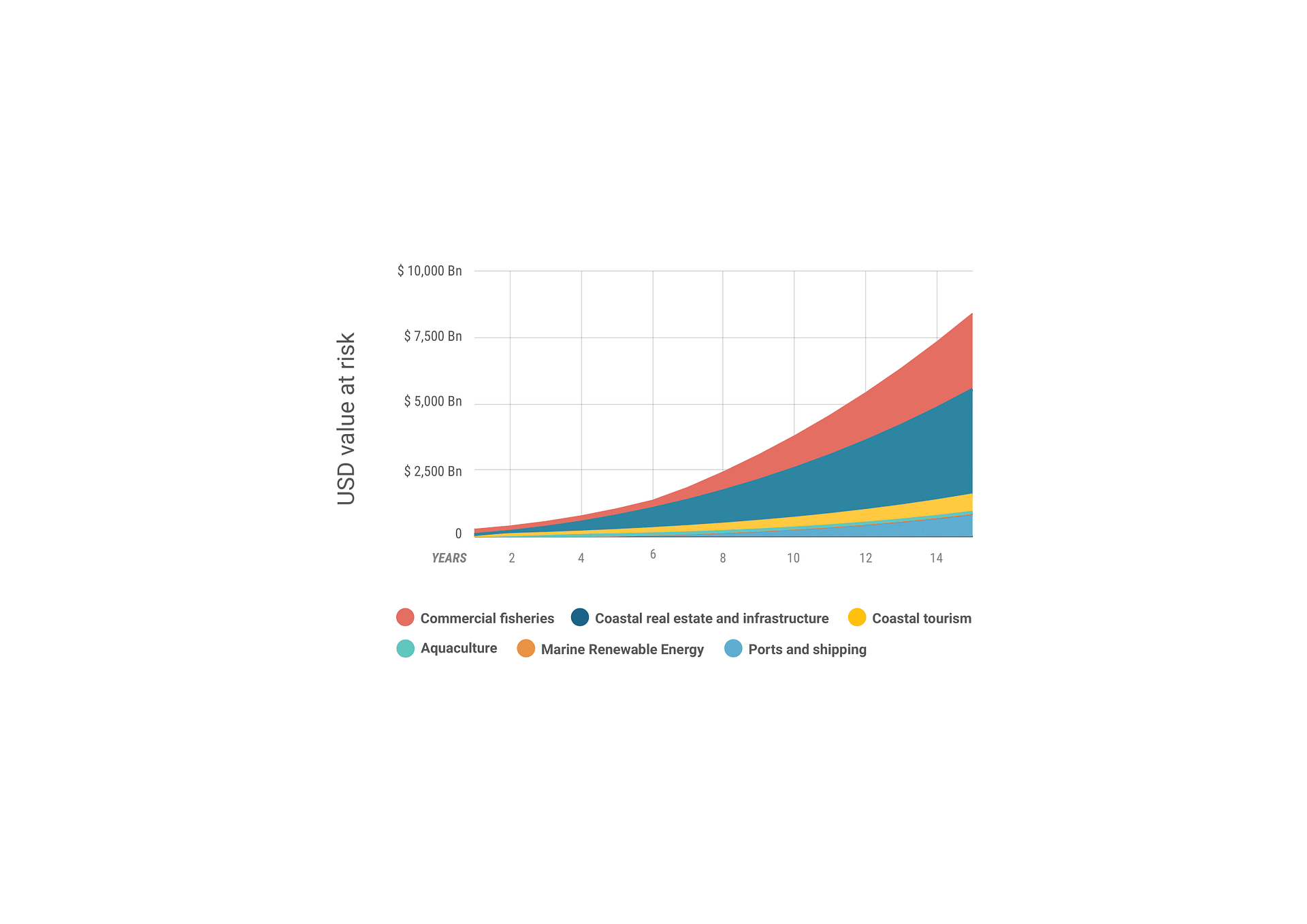

We found that up to two-thirds of publicly listed companies are, to some degree, dependent on a healthy ocean. There is significant VaR in a business-as-usual trajectory for the blue economy. Our global model estimates $8.4 trillion worth of assets and revenues are at risk in the next 15 years, and these risks are increasing exponentially. By adopting a more sustainable pathway, more than $5 trillion could be saved, according to our model.

This model can serve as a scenario-building and engagement tool for asset and portfolio managers to identify where exposure within an unsustainably managed blue economy may arise, and to see the effects of different interventions. While the methodology is designed for equities investors, the model is relevant for a wide range of financial services industries, including insurance, reinsurance, fund managers, those with sovereign debt, and asset managers.